-

1000

Startups applied to the 2018 programme

-

61%

of applications from adjacent industries

-

80%

partners believe prevention is the future for insurers

-

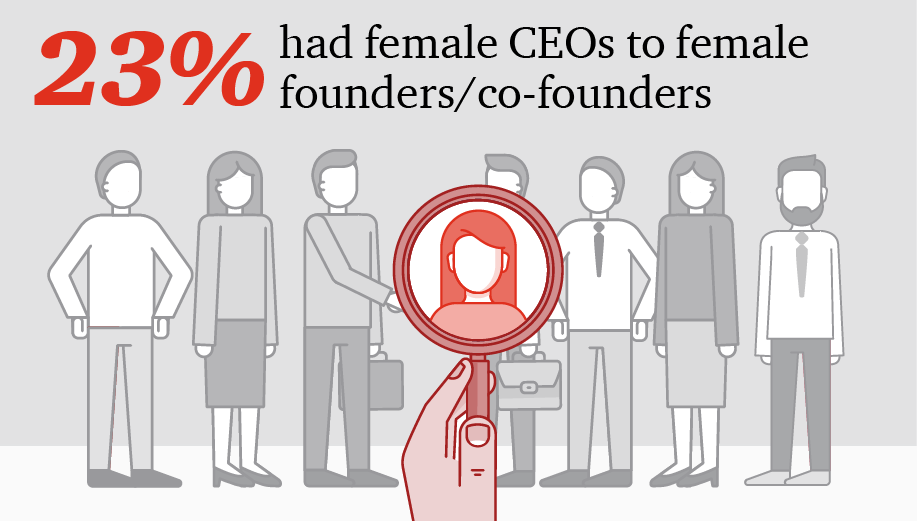

23%

of applications from female CEOs

“Over three years of Startupbootcamp InsurTech, the narrative surrounding InsurTech has shifted. We have moved from the expectation of disruption towards collaboration. Now, in year three of Startupbootcamp, this evolution is continuing but offering insurers the opportunity to innovate beyond the existing value chain.

In other words, the term InsurTech itself now increasingly falls short of describing what these startups offer. Rather, the emerging picture is now of an ecosystem that brings together adjacent industries to provide an improved service of greater value to insurers and their customers.”

Collaboration with startups from adjacent industries, brings insurers the opportunity to expand their existing value chain

Startupbootcamp applications bring in startups spanning agriculture, health, cyber-security, the sharing economy, wealth management and transport, and more. Startups from beyond insurance give insurers the opportunity to access different parts of the value chain, for example to move into prevention.

Startups can provide access to new data sources or offer new ways to drive value from data

Startups are increasingly mature in driving value from historic and existing data sources; whilst also bridging the gap between adjacent industries and making the data available for insurers.

Insurers and startups are increasingly looking at new propositions

Startups provide the expertise to insurers in areas where they would like to create new propositions. 84% of surveyed SBC partners are interested in finding an innovative solution in cyber, and 80% are interested in doing so in the sharing economy.

The InsurTech Ecosystem brings innovation and talent to the industry

Over the three years, InsurTech has brought diverse talent across technology and different industries. Innovation has moved from watch and learn, to collaboration and insurers are now exploring how to scale proof of concepts into their broader businesses.

Gender diversity is improving within InsurTech, but still has a way to go

23% of applicant CEOs are women, but men are five times more likely to hold a CTO position, whilst women are twice as likely to be chief marketing officers.

What's next for InsurTech

As startups scale, they could partner with reinsurers and own the value chain. However, threats are more likely to come from the tech giants.

Contact us

© 2015 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.