“Recent European IPO activity and largely positive aftermarket performance suggest we are entering a recovery phase of the IPO market. Diversified pipeline, strong market performance and low volatility continue to support a second half weighted IPO window with quality and valuation driving the investment decision.”

Kat Kravtsov

Director, UK Capital Markets

Key themes

Equity markets and macroeconomic overview

Broadly positive global equity indices performance, supported by improving macroeconomic conditions such as decreasing inflation and potential interest rate cuts, combined with lower volatility and strong pipeline, all resulting in a continued optimism for a sustained recovery of the IPO market in the remainder of 2024 and beyond.

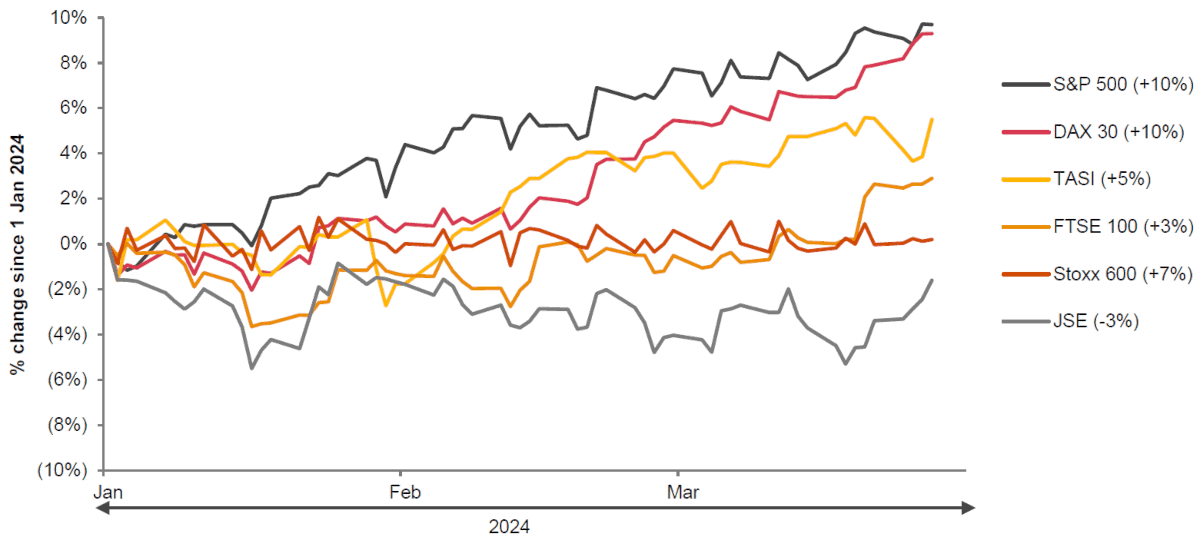

Historical performance of major equity indices in Q1 2024

Source: S&P Global Market Intelligence LLC 31 March 2024

The current market conditions are positive for investors as equity indices continue to rise and volatility is low, suggesting a more stable market environment, which supports IPO activity. Most of the major equity indices in the EMEA region have increased by c. 3-10% in the last quarter, while the JSE decreased by 3% over the same period. The S&P 500 recorded a strong gain of 10% over Q1 2024, reflecting outperformance of some technology stocks.

The key driver of positive market performance is the expectation that most of the major Western economies are on track to see inflation decrease from the highs seen in 2022 and 2023 to 2%, leading to potential interest rate cuts. GDP growth across EMEA regions is also set to improve in 2024 compared to 2023 with Europe, UK and GCC forecasted to grow at 1.5%, 0.6% and 3.7% respectively according to IMF data and PwC analysis. Africa is also expected to be the second fastest growing region globally, after Asia, in 2024, largely supported by the growing services sector.

EMEA IPO trends and outlook

EMEA IPO markets have seen a promising start to the year, driven by strong European issuance and several transactions in the Middle East, further supporting the optimism that the markets will continue to recover in the latter half of 2024. Positive aftermarket performance among the largest IPOs in the region, coupled with the more positive macroeconomic outlook, provide a window of opportunity for issuers to access the IPO market.

Whilst Q1 2024 IPO proceeds of $1.4bn raised in the Middle East are lower compared with the first quarter proceeds raised in 2023 of $4.1bn, the pipeline for the remainder of 2024 remains strong across the region driven by the continued privatisation drive and growing number of privately owned companies looking to IPO.

The Consumer Staples sector raised the highest proceeds in Q1 2024 at $2.7bn of the total $6.7bn EMEA IPO proceeds raised.

EMEA IPO activity (Q1 2020 to Q1 2024)

Source: S&P Global Market Intelligence LLC

Contact us