{{item.title}}

{{item.text}}

Download PDF - {{item.damSize}}

{{item.title}}

{{item.text}}

Risk is all around us and, in our complex world, changing all the time. Organisations must understand and manage risk if they are to be resilient to survive - and take risk, with eyes wide open, if they are to thrive and grow.

“We work together with our clients to find new ways to secure value and navigate uncertainty with confidence. At the heart of our business are diverse teams that bring the right ambition, skills and technology to solve complex problems together.”

The level of risk you need to manage today would scarcely have been imaginable, even recently. We can help you navigate this uncertainty, changing the way you predict, prepare and respond to risk, giving you confidence to make decisions that make the difference.

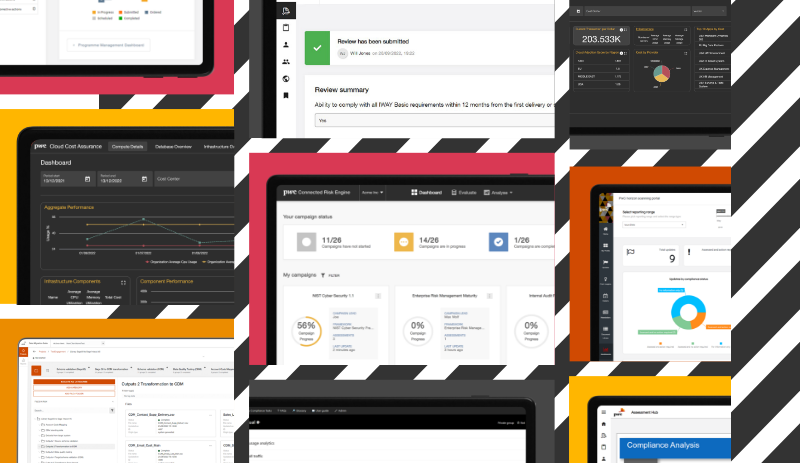

Today’s world is fast-moving, uncertain and unpredictable. Our digital products have been built to help better understand and navigate your business issues so that you can adapt and grow in the face of disruption.

“In a turbulent world, we know how important it is for our clients to navigate uncertainty with confidence. This means being forward looking, empowered by technology and the insights it brings. One of our key ambitions is to have a measurable, positive impact on society. We’ve taken the bold decision to start measuring how the outcomes of our work impact society on all of our projects.”

“At the heart of our business are diverse and talented teams to help achieve our goal of being pioneers in a world of changing risk. Join us and you’ll be part of an inclusive culture that enables risk professionals to thrive by nurturing innovation and curiosity. Our investments in technology and digital give our people the tools and skills they need to help our clients solve the problems of tomorrow, not just today.”

Risk Markets & Services Programme Director, PwC United Kingdom

Tel: +44 (0)7711 562241