Our stories

Be Well, Work Well

We’re committed to ensuring that care and our people’s wellbeing remains central to our culture. This year, we brought together all that we do to help our people prioritise their wellbeing as part of our new global approach called Be Well, Work Well.

Setting the scene

We think it’s important that we support our people and their wellbeing, to help them take care of themselves and to ensure the right support is available when it’s needed.

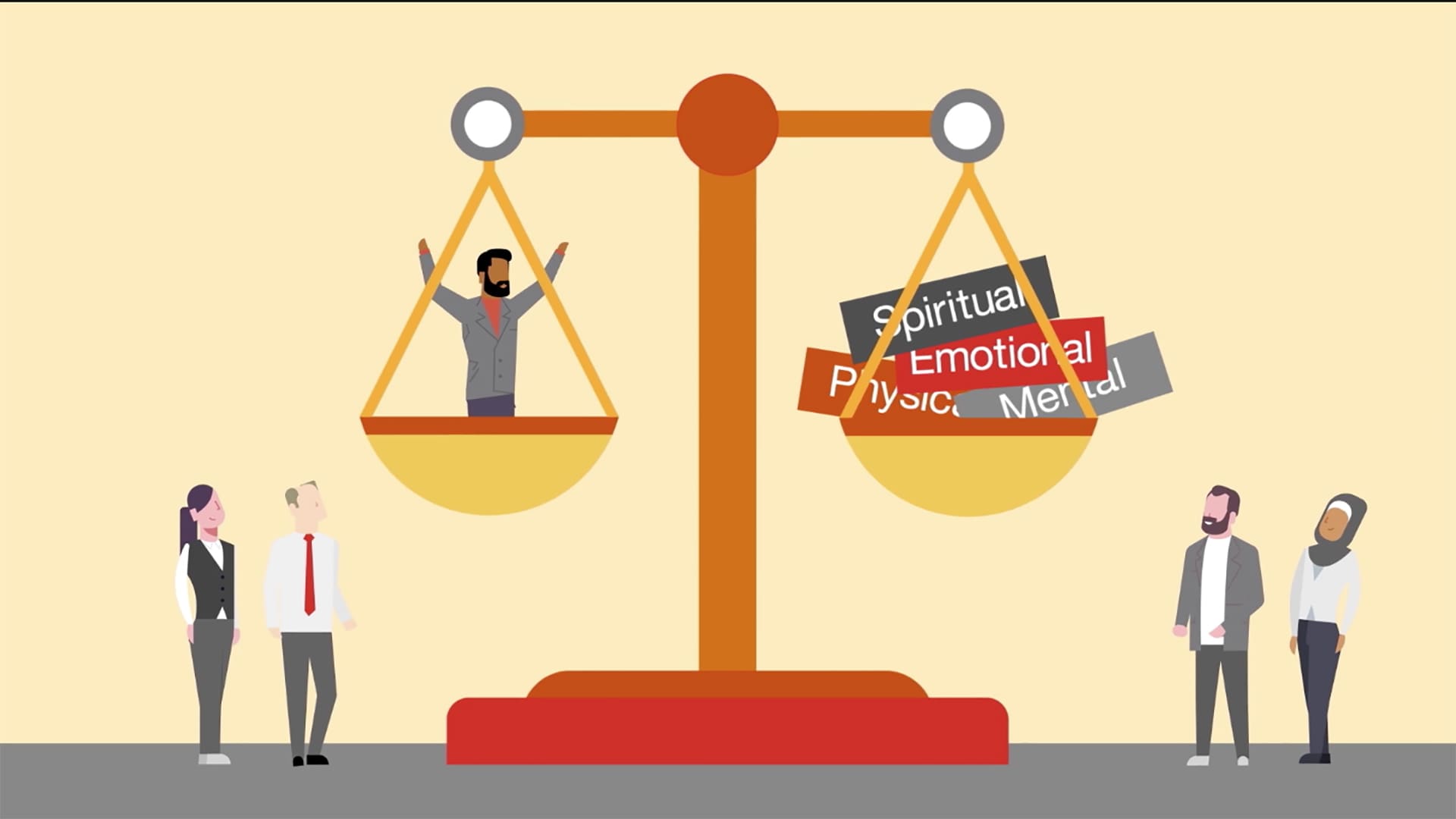

Our Be Well, Work Well approach encourages our people to think about four types of energy we all have, mental, emotional, physical and spiritual - and focus on how managing these energy aspects, keeping them in balance, can help us stay well and feel and perform at our best.

We also know that there are many aspects to wellbeing, and so we’re constantly expanding our approach and our offer to our people.

The following are some examples of initiatives we launched this year to support our people's wellbeing.

How we helped

Menopause in the workplace guide

Research shows that women going through the menopause are the fastest growing demographic in the workforce, and that three out of four experience symptoms. We worked closely with the Royal College of Obstetricians and Gynaecologists and the charity Wellbeing of Women to develop a Menopause in the Workplace guide. This provides information about the menopause; what resources, help and guidance is available at our firm and externally; and how we can all support women going through it. We’ve also run webinars hosted by experts in their field focused on various aspects of health, including infertility, menopause, and periods and endometriosis.

Financial wellbeing

We take seriously our responsibility to ensure our people are equipped with the right support and knowledge to help them navigate their way through the various financial challenges they may face over the course of their working lives. This year we launched a financial wellbeing hub which contains a range of personal financial resources. We also introduced our partnership with Canopy, a third party offering deposit-free rental insurance policies which helps renters to improve their credit score, and ran a series of talks by experts during November’s Talk Money Week.

#MyPromise campaign

We believe that making small promises to ourselves about how we will prioritise our wellbeing and promote a better work/life balance can make a big impact. By sharing our promises with others, and appreciating the commitments we all have outside of work that are important to us, we can support each other to make them a reality.

That’s why we asked our people to share their wellbeing commitments with each other and on social media, using the hashtag #MyPromise.

My promise

“We’re asking everybody to make a promise and think about what will make the biggest difference to them in terms of getting the balance right between work and home. And if we all know what everyone else’s promises are, hopefully we can all help each other to make them real.”

Making a difference

In this year’s employee survey, we saw an increase in the number of our employees positively responding to wellbeing questions. This included ‘It is possible to have a healthy lifestyle and be successful at PwC’ and almost 70% agreed that ‘The people I work for are considerate of my life outside of work’.

Our #MyPromise social media campaign had a reach of 715,000 with many of our people making commitments that were shared both internally and externally.

Our menopause and fertility webinars were attended by more than 500 of our people and made available on demand after the event. More than 75 questions were asked with feedback from one of the menopause webinar attendees saying: ‘I thought it was really good. Definitely answered some of my questions and lots of reassurance.’

Our popular mortgage surgeries have resulted in 1,700 mortgages being written since 2015, totalling nearly £500m. The discounted shopping portal our people have access to has led to an average yearly saving of £267,000 across the firm. We have also recently added eldercare support and a will writing service to our employee benefits offering.