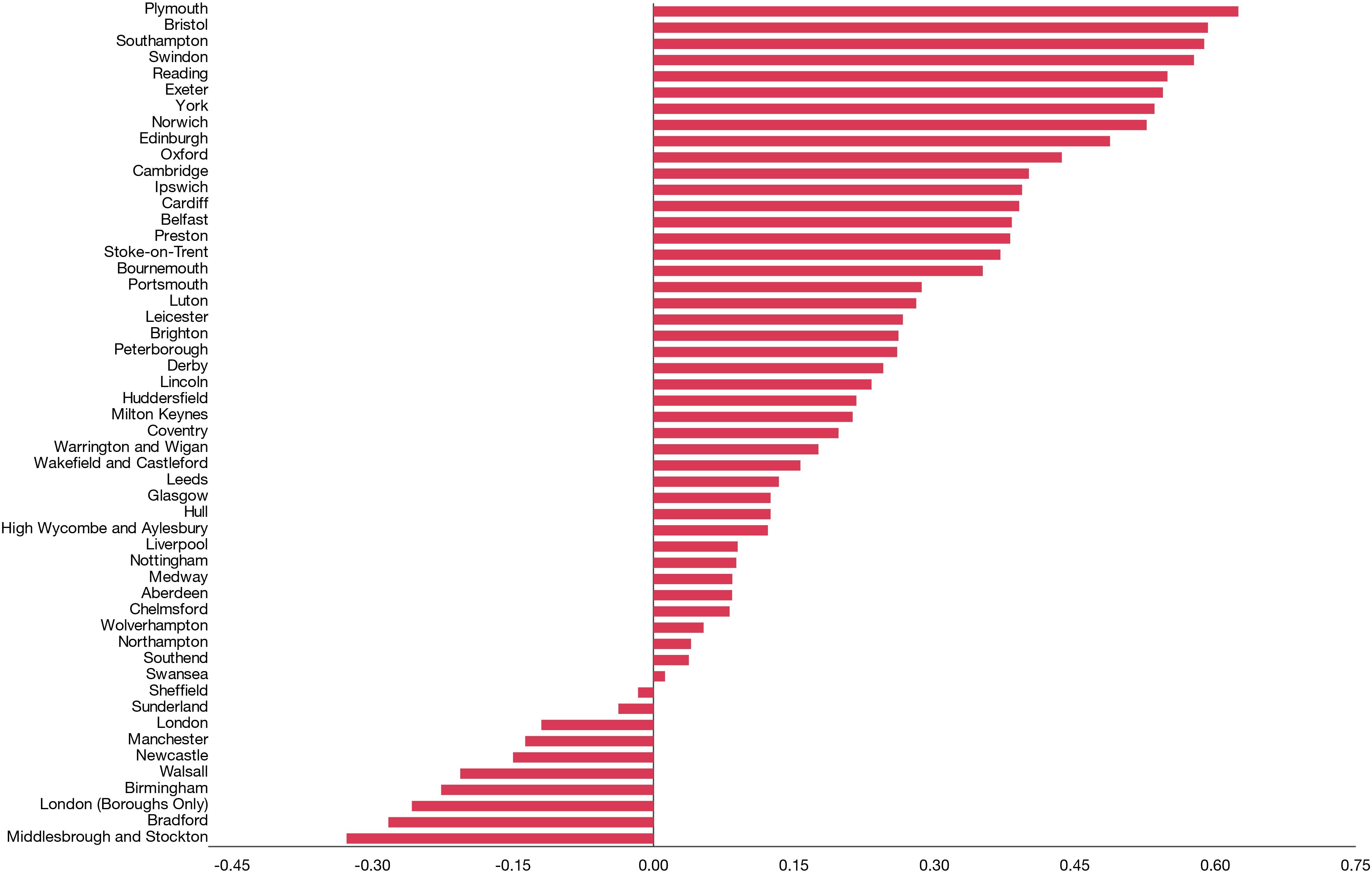

- Plymouth is the highest performing city in the annual Demos-PwC Good Growth for Cities Index, with Bristol rising to second place and Southampton remaining in third place.

Cities across the South West region lead the Index, with Plymouth, Bristol, Swindon and Exeter all being among the best performing cities, consistently scoring above the UK average for health & safety and skills.

The East of England and Yorkshire are home to the highest improving cities - Lincoln, Hull and York.

House price-to-earnings ratio sees the largest decline across UK cities as people continue to be priced out of living in cities as wage growth fails to keep pace with house prices.

Raising prosperity across the UK is needed more than ever, says PwC, as research shows growing inequality of access to housing, jobs and education remains a key issue across regions and cities.

Plymouth is the highest performing city in the annual Demos-PwC Good Growth for Cities Index, with Bristol rising to second place and Southampton remaining in third place. These cities scored particularly highly across income distribution, work-life balance, jobs and skills.

The Demos-PwC Good Growth for Cities Index ranks 51 of the UK’s largest cities (generally considered those with populations of at least 350,000 people), plus the London boroughs as a whole, based on the public’s assessment of 12 economic measures, including jobs, health, income, safety and skills, as well as work-life balance, housing, travel-to-work times, income equality, high street shops, environment and business startups.

Cities across the South West region lead the latest Index, with Plymouth, Bristol, Swindon and Exeter all being among the highest performing cities, scoring above the UK average for health & safety and skills. Despite this, the region’s cities score less well on new businesses and house price-to-earnings relative to the rest of the UK.

The East of England and Yorkshire are home to some of the highest improving cities in the Index. Lincoln is the most improved city driven by its performance on income distribution and jobs, followed by York and Hull, similarly improving their performance on income distribution and jobs respectively.

Raising prosperity and opportunity

PwC’s research shows that the public are most focussed on issues impacting their financial wellbeing, with measures such as income, jobs, and housing seeing the biggest increase in importance to the public. This shift in priorities has impacted cities’ performances, with the historically strong performing cities of Oxford and Milton Keynes seeing the most significant declines in scores, performing less well on income distribution, housing and high streets & shops.

Analysis in the Index shows the performance on house price-to-earnings ratio saw the largest decline across UK cities from last year’s Index - with the average house now costing over eight times the average earnings, compared to just four times in the 1990s. Cities with the largest social housing waiting lists, such as London, Birmingham, Manchester and Newcastle, are among the lowest performing cities in the Index.

Rachel Taylor, Government & Health Industries Leader at PwC, said:

“Raising prosperity across the UK is needed more than ever as we continue to see growing inequality in housing, jobs and education. There is an increasing imbalance within and between neighbourhoods, which is being driven by disparities in access to quality education, jobs and housing. This is felt not only across different regions, but also between people living within the same postcodes in cities.

“If we are serious about economic growth as a country we need to provide people and places with the foundations on which they can fuel that growth - access to jobs, skills and education and affordable homes. The public’s priorities are clear and together local and national government, businesses and the third sector need to work together through local growth plans tailored to local needs and opportunities to make this a reality.”

Driving economic growth

As the UK economy shows signs of recovery, economic bounceback is expected this year and into 2025, with cities home to high growth sectors such as transportation & storage, public sector & defence, and construction set to perform well. These include Cardiff, Ipswich and London which are expected to see some of the strongest growth of over 1.1% in 2024 and 1.9% in 2025. London is expected to be the best performer of the 51 cities due to its strong performance forecast for the technology, professional and administrative services sectors - all expected to see growth upward of 2.9% in 2025.

Some of the current Index's best performing cities, such as Plymouth, Bristol and Swindon, are forecast to have relatively average outlooks for 2024, consistent with lower performing cities such as Walsall, Birmingham and Nottingham.

For those cities projected to see the highest growth, much of this is down to a higher proportion of their economies being based in higher growth sectors, and the draw these sectors can have on investment, bringing more businesses, people, developers - and ultimately economic growth - to an area.

Carl Sizer, Chief Markets Officer at PwC, said:

“While cities and regions may be grappling with their own individual challenges, they are united by their desire for sustainable and inclusive growth. The new Government is moving at pace setting out a legislative agenda that starts to pave the way for how we are going to turn the dial on key issues holding back the UK’s economic growth, such as reform of the planning regime, improving work readiness of graduates and school leavers and investment in key national infrastructure and skills. However, this is against a backdrop of a challenging fiscal environment, so successful delivery will hinge on a level of close collaboration and innovation between national, local and regional governments, businesses, academia and the third sector that has historically rarely been seen.”

-Ends-

Notes to Editors:

About the Good Growth for Cities Index

The Demos-PwC Good Growth for Cities Index was established in 2011 and is updated annually.

The Index looks beyond core economic growth (GDP/GVA) and instead considers broad measures of economic wellbeing, including jobs, income, health, skills, work-life balance, housing, transport and the environment. The Index measures the performance of 52 of the UK’s largest cities, England’s Local Enterprise Partnerships (LEPs) and ten Combined Authorities, against a basket of 12 factors which the public consider most important when it comes to economic well being. These include jobs, health, income, safety and skills, as well as work-life balance, housing, travel-to-work times, income equality, high street shops, environment and business start-ups. More details on the methodology can be found in the report here www.pwc.co.uk/goodgrowth

2024 Good Growth for Cities Index results by city, ranked highest to lowest:

About PwC

At PwC, we help clients build trust and reinvent so they can turn complexity into competitive advantage. We’re a tech-forward, people-empowered network with more than 364,000 people in 136 countries and 137 territories. Across audit and assurance, tax and legal, deals and consulting, we help clients build, accelerate, and sustain momentum. Find out more at pwc.com.

© 2025 PwC. All rights reserved.