Reduced incentives and lagging infrastructure improvements stall UK electric vehicle demand

19 Sep 2023

Growth outlook for UK EV demand is slowing: UK customers intending to buy or lease an EV in the next 24 months decreases from 30% to 19%

Charging infrastructure remains a top cause of EV rejection for 40-50% of non-owners: Among prospects, charging duration named by 49%, limited range by 43%; among sceptics, long charging time named by 45%, limited range by 43%

Eight pure-EV suppliers active in UK market vs. 14-16 in European countries with comparable EV penetration rates

Reduced purchasing incentives making EV ownership less attractive for the next cohort of owners - higher upfront costs (vs. ICE vehicles) raised by 30% of sceptics

The UK’s electric vehicle (EV) infrastructure and accompanying supply rates have improved in the last year, but reduced government subsidies and incentives combined with lingering buying hesitance from motorists means that overall eMobility progress has remained neutral, according to new PwC research.

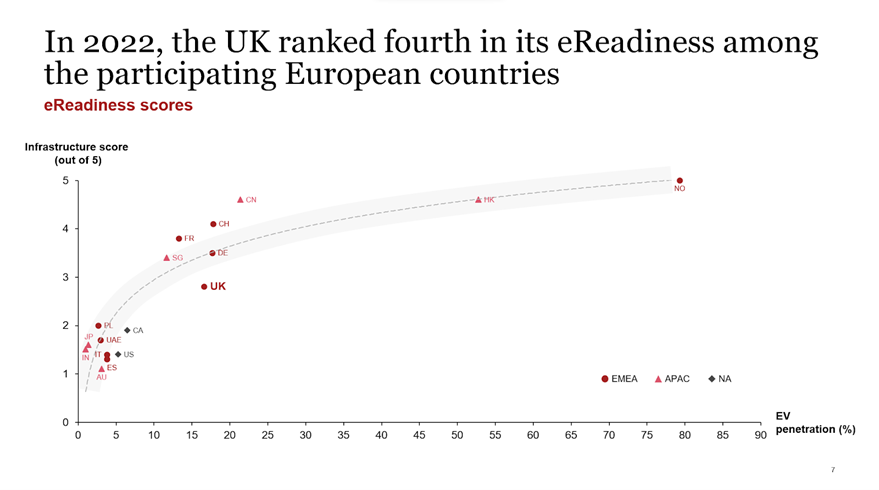

In the 2023 PwC eReadiness Study, the UK remained fourth out of eight European countries, with an index score of 2.6 out of a possible 5.0 (high eReadiness).

The index measures how ‘eReady’ a country is for the move to electric vehicles, calculated from four themes: government incentives, infrastructure, supply and demand. In the UK, government incentives (-0.3) and demand (-0.3) categories decreased from 2022, but infrastructure (+0.2) and supply (+0.2) increased.

Norway retained its spot as the most well-equipped European country for EVs, with an index of 4.0, followed by Switzerland (3.4), Germany (3.1), the UK and France (2.6), Italy (2.3), Spain (2.2) and Poland (2.1).

UK charging landscape improves whilst incentives calm

Following the Department for Transport’s decision to remove subsidies for EVs in July 2022, the UK has seen a c.50% reduction in total amount of maximum purchase subsidies. Whilst it is currently only one of three European countries to offer a full annual ownership tax exemption for EV owners alongside Germany and Italy, continuing to subsidise EV ownership could see an improved score in this category. Spain, which at 3.0 had the highest European index for government incentives, currently offers €7,000 to purchase EVs when legacy commercial vehicles are scrapped, until December 2023.

The UK has shown progress in the roll-out of charging infrastructure, with £1.6bn of investment contributing to a 37% increase in the number of charging points from April 2022 to April 2023. Fast charging points (>150kW) have also seen a six-fold increase across the UK from last year, with over 7,000 now in operation.

However, despite increasing public charging points by over a third, the UK is still lagging behind with its overall infrastructure compared to other countries with similar percentage of EV penetration.

Infrastructure scores of 17 participating countries compared against % of EV market penetration. Source: PwC eReadiness Study 2023

Globally, the survey found that battery-related concerns were the main causes to prospective EV owners hesitating to purchase, as charging duration, limited range and uncertainty around battery lifetime were the top three reasons that had discouraged respondents from buying an electric vehicle.

Battery and charge issues are not limited to prospective owners, as the research found that global owners said the three main issues they were facing with their EV were long charging times (42%), lack of public charging network (41%) and limited range (35%).

“There continues to be positive moves in improving the EV offering for UK motorists, but perception is critical here, and any hints of a softening of intentions risks dampening demand for new EVs. Upturns in perception are possible, but they are strongly reliant on consistency and clarity around key factors such as financial incentives and charge point roll-out plans.”

Supply improvements met with hesitance in demand

The UK supply category saw growth of 0.2 in this year’s survey, mainly due to five new entrants bringing the total number of pure-EV suppliers* in the country to eight. However, the UK continues to lag behind France, Germany and Norway on this dimension, who have 16, 16 and 14 pure-EV suppliers respectively.

However, marginal improvements in supply were met with a cooling demand outlook: The portion of UK consumers willing to buy a BEV in the next two years dropped from 30% to 19%. This could be linked to reduced buying subsidies, as globally, the study found that c.40% of prospective EV owners said that a higher upfront price compared to an ICE vehicle was a key factor that had discouraged them in purchasing an EV. Among current owners, a global average of 62% said they had made use of economic incentives to purchase an EV.

Despite challenges in convincing would-be EV owners, there was clear positive sentiment among current EV owners, with a global average of 86% saying they were satisfied with their current EV and 70% stating they would not switch back to an ICE vehicle. Main drivers of satisfaction saw driving experience (47%), lower operating costs (43%) and ease of charging solutions (34%) as the highest scoring global averages.

“One of the most interesting points from this year’s survey is such clear positive sentiment from current EV owners, given that 70% wouldn’t switch back. Yet we still see so many persisting concerns by those considering an EV purchase. The UK’s roll-out of charging facilities and infrastructure has made some substantial progression and it will perhaps take consumers to see that progress first-hand to challenge their doubts and move closer to an EV commitment. Consumer education and awareness also has a key role to play in addressing these concerns. Heavy goods and light cargo vehicles are the next piece of the puzzle in wider EV adoption, so we expect those to be the next areas of focus for the industry.”

About the research

This year, 18 countries participated in the eReadiness study, adding to last year’s 7 European countries

The markets considered span across the North America, EMEA and APAC regions:

NA - Canada, USA

EMEA - Norway, Germany, UK, Switzerland, France, Spain, Italy, Poland, UAE

APAC - China, Thailand, Japan, Hong Kong, Singapore, India, Australia

12,500+ CAWI interviews were compiled from private customers to provide updated perspectives on the short-term development of the e-mobility business in these 18 markets (for both BEVs and PHEVs)

*Companies defined as pure-EV suppliers are: Aiways, BYD, e.GO, Fisker, Genesis, Geometry, Hiphi, Hongqi, Leapmotor, Lucid, Lynk&Co, NIO, ORA, Polestar, Rivian, Tesla, VinFast, WEY, Xpeng, and Zedriv.

eReadiness category KPIs and weighting:

Government incentives:

Grants (25%): Total amount of maximum purchase subsidies, national and local grants, scrapping bonus per EV granted to a consumer by the government

VAT exemption (25%): Exemption or maximum reduction on VAT granted to a consumer when buying an EV

Registration tax reduction (25%): Exemption or maximum reduction on one-off registration taxes, import taxes or CO2/NOx taxes

Annual ownership tax exemption (25%): total maximum amount of annual ownership tax reductions granted to a consumer by the government

Infrastructure

Charging points per thousand cars (50%): Number of public charging points per thousand cars (total circulating fleet)

Penetration of public fast charging points (30%): Ratio of public fast charging points (over 150 kW) per km of motorway

Renewable energy share (10%): Share of renewable energy produced

Gasoline vs. electricity cost (10%): Ratio of driving costs per 100 km of ICE vs. BEV (considering gasoline for ICE and slow charging for EVs)

Supply

BEV penetration (50%): Share of BEVs based on total cars sold (2022)

Top models annual depreciation (25%): Depreciation rate of top 4 selling models by country from 2018 to 2022

Pure EV players (25%) - Pure EV players with active sales in country

Demand

Willingness to buy (33%): Consumer willingness to buy a BEV in the next two years year (% of respondents)

Share of short distance drivers (33%): Share of respondents driving 30 km or less per day

Household income (33%): Average income of consumers respondent to the survey

About PwC

At PwC, our purpose is to build trust in society and solve important problems. We’re a network of firms in 156 countries with over 295,000 people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what matters to you by visiting us at PwC.

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see how we are structured for further details.

© 2023 PwC. All rights reserved.