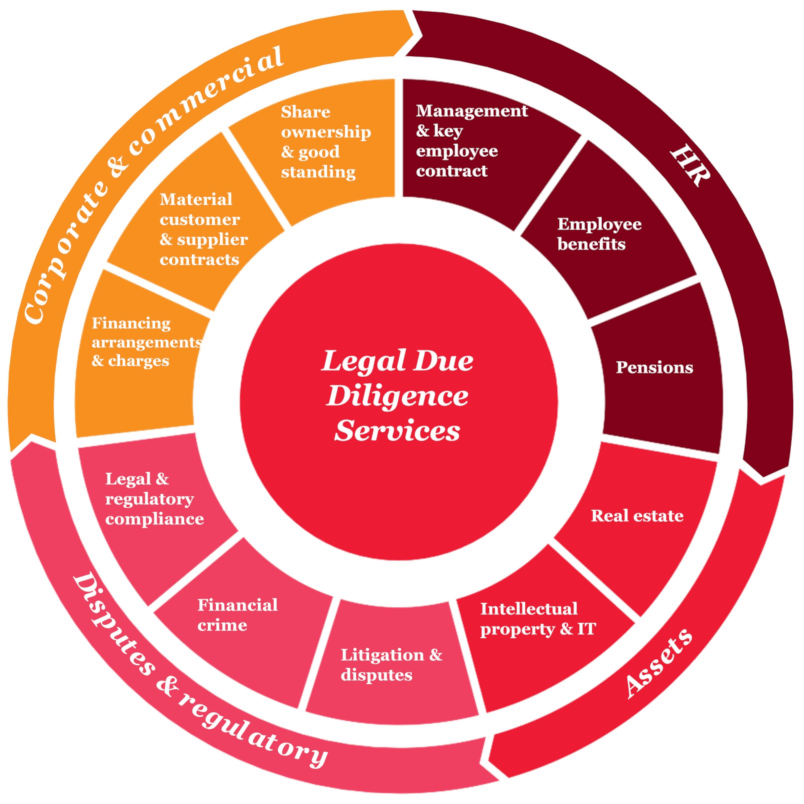

Legal due diligence is a critical part of any M&A transaction. It needs to be done thoroughly and forensically, but also at an appropriate price point taking into account the nature of the target’s business and deal size. Our team of experienced due diligence lawyers can provide you with a full-service review on both domestic and cross-border deals across the whole range of industry sectors, whether as a stand-alone legal service or as part of a multi-disciplinary PwC due diligence team.

We are experts in both buy-side M&A and vendor due diligence and also conduct major global reviews for corporate separation and integration projects. We provide a tailored, tech-enabled service and focus on key value issues and deal-blockers while delivering clear, commercial and practical recommendations.

How do we do it?

We draw on our extensive network of specialist lawyers around the globe, all centrally project managed and with oversight by a central team, to conduct the required due diligence, often against aggressive deal timelines. We can also deploy market leading LawTech, including machine-learning based tools, and our off-shore delivery centres to improve efficiency, rigour and cost. Our experience of carrying out integrated, multi-disciplinary, reviews also enables us to take account of the wider due diligence findings in our reviews.

Our team is able to call on subject matter experts from across PwC on a range of broader business issues, including HR and reward, pensions, insurance, environmental and cyber security. This enables us to take a more holistic approach to due diligence than other law firms and means we can report without caveats or the need to appoint external advisors. We also frequently support clients’ appointed deal lawyers, enabling them to focus on the legal M&A advisory role.

Case studies

- Cross-border legal vendor due diligence (global energy business)

- Cross-border legal vendor due diligence (global telecoms business)

- Cross-border buy-side legal due diligence (private equity)

Cross-border legal vendor due diligence (global energy business)

We carried out a legal vendor due diligence review for a global energy business in connection with its potential sale of a large portfolio of properties. We utilised data extraction technology and our off-shore centre for document review in Belfast to deliver cost efficiencies, and we reported our findings via an interactive dashboard report.

Cross-border legal vendor due diligence (global telecoms business)

Our legal team worked alongside PwC’s financial and tax due diligence teams to produce an integrated cross-border due diligence report for a global telecoms business. We used data extraction technology and an off-shore document review team to deliver time-savings (as well as cost efficiencies) on a substantial “all contracts” review within the overall deal timetable.

Cross-border buy-side legal due diligence (private equity)

We provided a global legal due diligence review for a French private equity firm on its investment in one of the world’s leading tax free shopping and currency conversion services.

Our full-service legal due diligence work was carried out as part of an integrated PwC due diligence service, including financial and tax due diligence. Our team also worked closely with the global law firm advising our client on the legal M&A transaction, including providing support on the disclosure process and global public registry searches pre-closing.

Contact us

Partner, Legal Business Solutions, PwC United Kingdom

Tel: +44 (0)7483 416629