Quarterly corporate debt activity

Corporate debt activity by year

Source: Dealogic

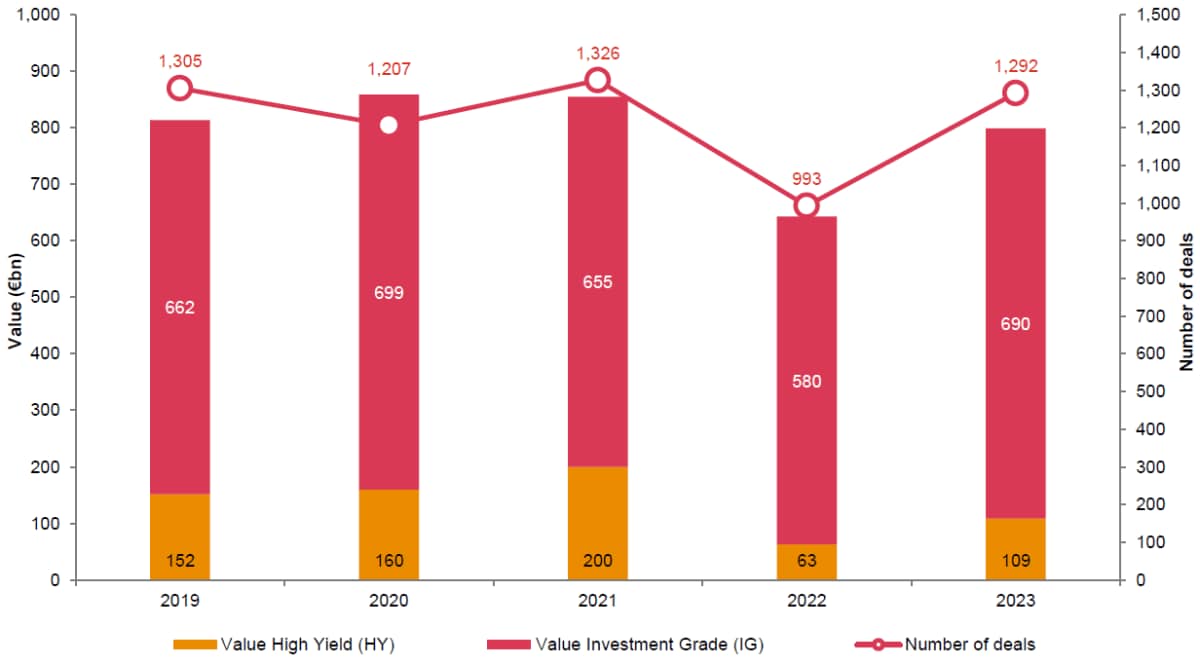

Overall, 2023 was a better year for the European corporate bond market compared to 2022. Despite persistent macroeconomic challenges, including continued high inflation, the cost of living crisis and geopolitical conflicts, European issuers had the appetite to refinance their debt on the expectations that interest rates had peaked before tapering off at the end of 2023 and into 2024. There was a similar picture when analysing the UK corporate bond market as well, with a strong recovery compared to the previous year. Overall, there were 1,292 issuances and c.€799bn raised in 2023, compared to 993 issuances and c.€644bn of proceeds raised in 2022, with increases across the board for Investment Grade, High Yield, and green/ESG bonds.

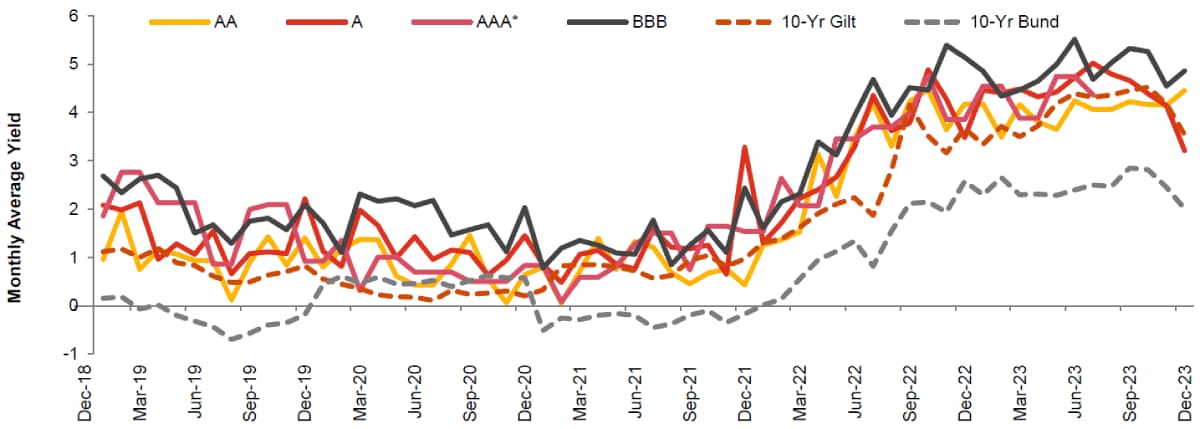

The shift in average yield to maturity has been a significant story in the year. This came as a direct result of major central banks actions to curb inflation and ease the cost-of-living crisis, by raising base interest rates a number of times throughout 2023. The Investment Grade market (bonds with ratings BBB- and above), saw average yield-to-maturity increase from 3.33% in 2022 to 4.79% in 2023, highlighting the increase in pricing faced by even the most stable blue-chip issuers. High Yield bonds, those rated BB+ and below, saw the average yield to maturity increase from 7.0% in 2022 to 8.08% in 2023; and in Q4 2023, B rated bonds had an average-yield-to-maturity of 9.92%, highlighting the near double-digit pricing faced by issuers when raising debt.

Monthly Average Yield HY

Source: Dealogic

Monthly Average Yield IG

Source: Dealogic

The High Yield bond market also recovered after a lacklustre year in 2022. Despite increased interest rates, expectations remained that rates would start to stabilise (albeit at a higher level) Issuers started to come to market again with expectations aligned to this higher pricing. The year saw 251 deals, a significant increase compared to 148 deals in 2022. Proceeds raised were also significantly higher, with c.€109bn raised in 2023 versus c.€63bn in 2022.

The Investment Grade market continued to be the main driving force behind corporate issuances in 2023. As pricing surged, issuers with the strongest balance sheets and credit ratings stood to benefit from increased investor demand. In total there were 1,041 deals amounting to c.€690bn of proceeds compared to 845 deals and proceeds of c.€580bn in 2022.

Green/ESG bonds

Green/ESG bonds activity by year

Source: Dealogic

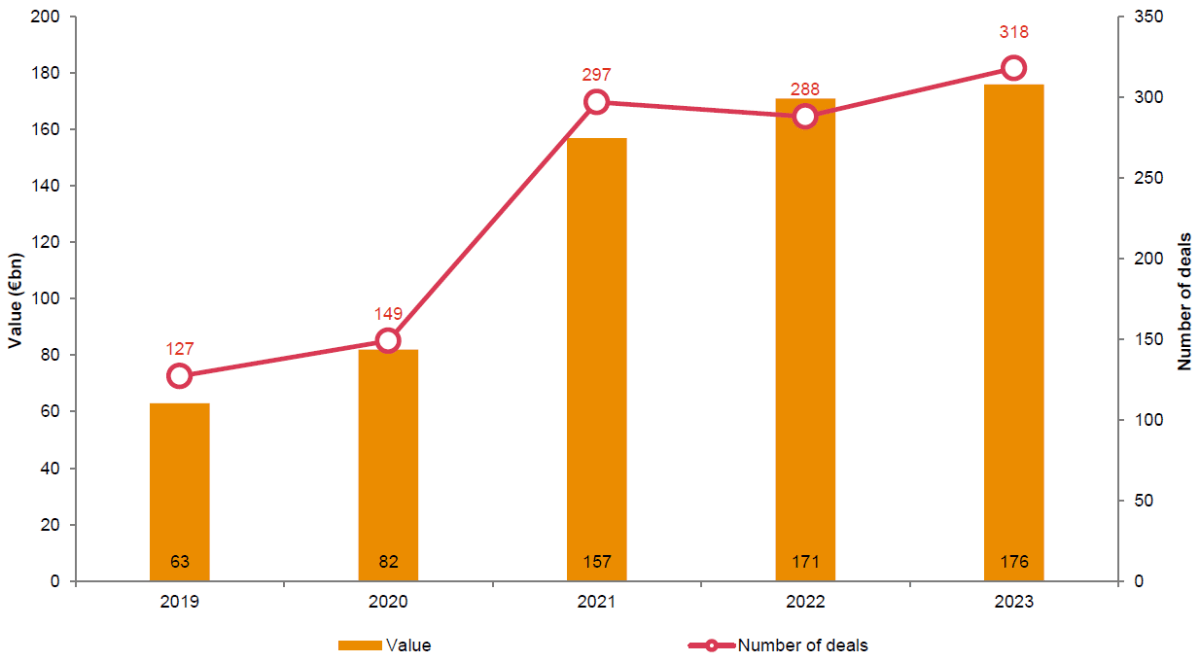

The green/ESG bond market in Europe had its best year on record in 2023, as companies continue to accelerate their decarbonisation plans and look to attract investors with sustainable finance in mind. Overall, 2023 finished with 318 completed deals with proceeds of c.€176bn raised, compared to 288 deals and c.€171 of proceeds in 2022. The year started strongly after a drop in the second half of 2022, and green/sustainable bond issuances maintained a fairly consistent level of issuances throughout the year, despite the wider turbulence in the overall market.

The largest green bond issuance in the quarter was by Engie SA, the french multinational utilities company. They issued a c.€4bn, 4-tranche green bond in August 2023 with a BBB+ rating and yield-to-maturity of 4.18%. Since adopting their strategic roadmap to be Net Zero Carbon by 2045 they have been an active issuer in the green/sustainable bond space, despite their core business focusing on energy such as electricity generation and distribution, natural gas and petroleum.

Of note, the average yield-to-maturity for the top 10 green/ESG issuances show a slight premium compared to the top 10 Investment Grade issuances for 2023. This highlights how the “greenium”, a premium of more favourable pricing and yields for sustainable issuances over non-green issuances, is still a feature of the European corporate debt market. In 2023, the top 10 green/ESG issuances had an average yield-to-maturity of 4.39%, compared to 4.75% average yield-to-maturity for the top 10 Investment Grade issuances in the year.

Outlook for 2024

2023 ended on a cautionary note, with recession fears remaining across developed economies, economic forecasts indicating a contraction in the Eurozone economy in Q4 2023 and an uptick in inflation expected to last into Q1 2024. As a result, December 2023 only had 29 issuances and proceeds of c.€8.5bn in proceeds after a strong November which had 166 deals and c.€83.3bn raised. Given the uncertain economic outlook, all eyes will be on the upcoming meeting of the European Central Bank on when to start cutting interest rates. Looking further ahead, European Parliament elections in June 2024, a likely U.K. general election in the second half of 2024 and the U.S. Presidential elections could all play a role in how bond markets perform in the year.

Contact us