What are capital markets?

Capital markets are financial highways where companies and governments go to raise funds. It’s where stocks, bonds, and other securities are bought and sold by investors and hence these markets facilitate the flow of funds between issuers and investors.

What is the role of capital markets in the net zero journey?

Capital markets have the potential to drive the allocation of financial resources towards sustainable and climate-friendly investments. This creates a positive feedback loop that supports the transition to a net-zero economy. Facilitators play a key role in the issuance of these transactions and hence the transition to net zero. By mobilising funds, encouraging transparency, and providing market incentives, capital market participants such as banks facilitating these transactions play a vital role in achieving the climate goals set out in the Paris Agreement.

What are facilitated emissions?

To provide a comprehensive picture of their environmental impact, facilitators in the capital market are looking to identify, measure and address the indirect emissions resulting from servicing (rather than financing) these capital transactions, i.e facilitated emissions.

How are facilitated emissions measured?

As part of our independent benchmarking based on a set of 2022 Sustainability- related disclosures, we note that the majority of institutions still have not disclosed the emissions facilitated through their capital market activities.

Given the increasing scrutiny from key stakeholders (i.e. management, investors, regulators), coupled with the finalised approach to calculating facilitated emissions published by PCAF in December 2023, we anticipate that disclosing facilitated emissions related to capital markets will be next on the agenda for these institutions.

The purpose of this document is to highlight the key practical considerations for financial institutions adopting PCAF when calculating facilitated emissions. In particular, the scope of facilitated emissions, how they differ from financed emissions, and key insights into the challenges which are involved in modelling emissions associated with the capital market activities.

Overview and current landscape

How are facilitated emissions linked to issuers’ emissions?

There are multiple players within capital markets including issuers, investors and facilitators. In the diagram below we have set out a high level example to illustrate the different players in the market as well as highlight the difference between capital markets financing and traditional lending activities.

Diagram illustrating the link between key players in emissions modelling

“Facilitators are mostly large international banks that conduct substantial capital markets facilitation activities including advising issuers on structure, pricing, and process; preparing materials for and engaging with investors; and arranging and guiding clients on roadshows.”

PCAF - Facilitated Emissions Dec 2023

How do facilitated emissions differ from financed emissions?

As noted by PCAF, facilitated emissions differ from financed emissions in two key respects:

- They are off-balance sheet (services rather than financing) and often there is no financial risk taken (e.g credit risk)

- They take the form of a flow* activity (i.e temporary) rather than a stock activity (i.e held on book)

How are facilitated emissions measured?

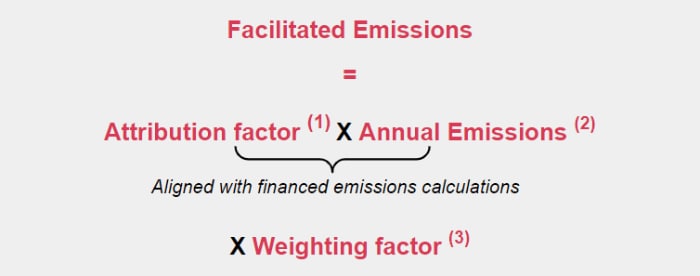

As per PCAF guidance, an attribution factor is multiplied by the annual emissions of the issuer to calculate the facilitated emissions.

(1) Attribution factor

The attribution factor represents the split of emissions between the different facilitators of the transaction. This is calculated as follows:

Where,

Facilitated amount is the bank specific transaction amount where available; otherwise the league table credit is used to apportion the total transaction amount to the bank. Please refer to Decision 4 below for further details on how this is calculated.

(2) Annual Emissions

This is aligned with the financed emissions calculation and data considerations are covered in Decision 1 below.

(3) Weighting factor

This represents the proportion of emissions from an issuer which is the responsibility of the facilitator and is set to be 33% by PCAF in the finalised guidance in December 2023. Please refer to Decision 3 below for further details.

The key difference between calculating financed and facilitated emissions is the concept of the weighting factor. We also note that the numerator of the attribution factor is driven by facilitated amount (as opposed to outstanding amount on financed emissions). The aforementioned nuances as well underpinning key considerations are the focus of this paper. Lastly we note that co managers are currently out of scope of the PCAF guidance.

Key Considerations

In this section we highlight the key data and modelling decisions as well as practical considerations for financial institutions with a focus on the attribution factor calculation.

Decision 1: Data and data quality

It is acknowledged that data availability is a key challenge given level of disclosures and lags associated with emissions data being reported. PCAF data quality methodology helps to bridge these data gaps through the use of proxies. This approach is finalised by PCAF and is aligned with the financed emissions methodology.

Practical considerations

PCAF does not recommend a preferred data source and financial institutions face a number of challenges when sourcing data. We highlight below some key considerations when financial institutions are choosing data providers:

- Appropriate due diligence should be carried out on external data providers to ensure transparency around methodology and approach to data gathering from these third party sources.

- Multiple providers can be used to increase portfolio coverage and reduce reliance on data quality from one provider. Analysis can be carried out to identify most appropriate set of providers.

- Data should be selected to ensure consistency of time periods across each model component (i.e emissions, EVIC and transaction amount).

- The stability of data should be checked, i.e data being overridden and no history available.

- Inclusions and exclusions from data sources should be aligned with guidance. For instance type of facilitators (active and passive bookrunners) and asset types (short term products).

- Where facilitated emissions calculated using PCAF will also be used to meet other sustainability reporting requirements in the future, entities will need to take consider any relevant guidance in those other reporting requirements when assessing data sources.

- For the league table used in calculating transaction amount, we note that PCAF mentions 2 data sources namely Dealogic and Bloomberg. For further details please refer to Decision 4 for further details.

“Financial institutions should use the most recent, high-quality data available for calculations. Although high-quality data can be difficult to obtain, data limitations should not deter financial institutions from calculating and reporting facilitated emissions. In these instances, data quality scores can help institutions to develop a strategy to improve data over time.”

Decision 2: Time period

Facilitating an activity within the capital results in only a temporary link with a transaction (i.e flow activity). In contrast, a loan is usually held for extended periods of time on a balance sheet and is classified by PCAF as a stock activity.

PCAF finalised the decision to use the flow approach which requires facilitated emissions to be accounted for only for the year in which the transaction takes place to represent the short term association of facilitators to these transactions. PCAF considered the averaging method as part of consultation but the general consensus was to use a fixed time period.

Practical considerations

PCAF identifies that the time period over which facilitation activity is captured can cause volatility in balance sheet reporting year on year due to variation in activity level in the capital markets. As such PCAF requires financed and facilitated emissions be reported separately.

To determine the most representative baseline, financial institutions should factor this volatility into their baseline year selection, in addition to other factors such as impact of Covid on the transaction amount.

“…the association with the capital market transaction shall be accounted for in the year the facilitation occurs, using the reported or estimated annual emissions of the issuer in that year. All the transactions during the year are then aggregated over that one year to calculate the total facilitated emissions. This annual period is selected to be in line with other parts of the PCAF Standard..”

Decision 3: Allocation of emissions between different market participants (i.e weighting factor = 33%)

This section of the methodology has recently been finalised by PCAF (December 2023 publication).

The proportion of emissions from an issuer which is the responsibility of the facilitator compared to the investor (i.e the weighting factor) needs to be determined.

In December 2023, following feedback from the working group, PCAF has finalised this decision and the weighting factor is set to be 33%. This is derived from the Global Systemically Important Banks (G-SIB) classification which is a measure used by G-SIBs to classify the relative importance of arranging activity in the overall financial system, under the Basel Committee’s methodology.

PCAF acknowledges that this is a conservative weight as it equals the highest weighted relative importance of underwriting activities versus balance sheet exposure according to the Basel Committee on Banking Supervision’s Basel Framework in the 11 years since the G-SIB assessment reports began in 2012. For instance, we note that as part of consultation phase, PCAF suggested a weighting factor of 17% which is the current weight while the 33% is the weight used prior to 2018.

PCAF also notes that financial institutions can report the facilitated emissions using a 100% weighting but this is in addition to the 33% weighting and not instead of. Furthemore this should be supported by clear narrative.

PCAF noted that the weighting factors are simple to compute and transparent. They can be applied across both bonds and equity and provide a consistent approach across facilitators.

PCAF contrasted the 33% weighting and the optional 100% weighting which can be broadly summarised as follows (marked with x for where applicable across each respective option):

| G-SIB weighting: 33% |

Optional weighting: 100% |

|

| Mitigates criticism of facilitators being accused of not taking full responsibility for their activity |

- | × |

| Allows for the differentiation between financed and facilitated emissions |

× | - |

| Requires periodic refresh of component |

× | - |

Practical considerations

- This decision was finalised in December 2023 and hence any financial institution which has previously disclosed their facilitated emissions number based a weighting which is not 33% might be looking to restate prior year values. In such instances, it is critical to have clear narrative in the disclosures for the reason for restatement to ensure full transparency and reduce reputational risk especially if this represents a reduction in disclosed emissions.

- PCAF also requires clear disclosures of the weighting factor of 33% in reports by financial institutions.

- Financial institutions are also allowed to report the facilitated emissions using 100% weighting but this is in addition to the 33% weighting. Furthemore this should be supported by clear narrative.

“… a unit of facilitated emissions is not equal to a unit of financed emissions (or insurance-associated emissions) given that no direct funding is provided by the financial institution to the company producing emissions in the real economy; combined with the very short-term role facilitators have in their roles as arrangers.”

Decision 4: Allocation of emissions between facilitators of a transaction

PCAF recommends that bank specific transaction amount is used where available otherwise the league table credit is used to apportion the total transaction amount to the bank. The league tables rank the involvement of each bank in the total capital market transactions. This is calculated based on the fees or volume of transaction.

Furthermore PCAF excludes co-managers from scope because they are not accounted for in league table credit and their fees are not considered material compared to Lead Bookrunners (normally only 5-10% of total fees).

Source: PCAF - Facilitated Emissions Dec 2023

Practical considerations

- It is key for financial institutions to benchmark the different providers and identify the most appropriate set of providers based on portfolio coverage as well as consistency in time period with other model components.

- PCAF allows the use the league table information based on either volume or fees. However the chosen approach should be clearly disclosed.

- In some instances, the credit league table excludes some capital market participants and hence alternative sources of data may need to be identified and clearly disclosed.

“As a first preference and if the data is readily available, the specific volume facilitated by the individual financial institution shall be used to determine what proportion of the ‘facilitated’ part of the transaction each facilitator takes responsibility for. If this data is not readily available, league table credit shall be used.”

Decision 5: Reporting

Facilitated emissions are to be reported separately from financed emissions. However, PCAF does not provide specific guidance around reporting and disclosure of facilitated emissions as they noted the lack of industry guidance on target setting for capital markets.

Practical considerations

PwC carried out a benchmarking exercise on sustainability disclosures across a set of market participants and noted the following best practices:

- Disclosing both absolute and intensity metrics.

- Reporting year on year movement from baseline emissions further increases transparency.

- Lastly, reporting information subject to internal review and external assurance will increase confidence in the disclosures.

Please refer to the independent benchmarking for further details.

We also note that PCAF requires institutions to set up a restatement policy and clear disclosure of the quantitative thresholds underpinning the restatement.

“Facilitated emissions shall be reported separately from financed emissions reporting. For the avoidance of doubt, facilitated emissions and financed emissions are not, and are not intended to be, directly comparable. Thus, facilitated emissions and financed emissions shall not be aggregated, but must be reported separately under the GHG Protocol scope 3 category 15 (Investments).”

How can PwC help?

We have extensive experience supporting our clients in the Financial Services sector in navigating the various challenges that comes with emissions modelling and measuring climate related risks. This includes: (Please refer below)

Across all these offerings, we have a number of digital assets including a PCAF compliant cloud based tool (Portfolio Emissions Manager - PEM) which supports financial services in quantifying their carbon footprint financed and facilitated emissions), forecasting their decarbonisation pathway and transition planning.

Please reach out for a demo of the tool and how it can help your institution in the net zero journey.

Data sourcing and processing – selecting appropriate data based on defined criteria, sensitivity and benchmarking analysis, use of proxies when data not available

Emissions modelling – model design, development, validation and implementation

Governance and monitoring – defining and embedding, risk appetite, governance and monitoring framework as well as restatement policies

Portfolio and counterparty management using analytics and insights - support active portfolio and counterparty management as well as customer onboarding

Decarbonisation strategy and optimisation - including dynamic balance sheet and credibility assessment considerations

Embedding financed emissions output into the business – sustainability reporting, transition planning and sector deep dive analysis

Across all these offerings, we have a number of digital assets including a PCAF compliant cloud based tool (Portfolio Emissions Manager - PEM) which supports financial services in quantifying their carbon footprint financed and facilitated emissions), forecasting their decarbonisation pathway and transition planning.

Please reach out for a demo of the tool and how it can help your institution in the net zero journey.

[1] Launched in September 2019, PCAF (Partnership for Carbon Accounting Financials) is an international collaboration of financial institutions which provides a framework and guidelines to calculate and report carbon footprint. In December 2023 the Working Group published a final methodology for the measurement and disclosure of facilitated emissions following consultation.