Both retail and consumer goods are rapidly evolving sectors. Top-line pressures and cost headwinds are squeezing margins as consumers change the way they live, work, play, and shop. Emerging technologies are personalising customer experiences. Competitive intensity is increasing with disruptive brands, new business models, acquisitions and divestments. And heightened regulatory and public scrutiny is raising the bar for responsible businesses.

In this dynamic landscape, you need to deliver complex transformations. That could be rethinking your cost base, unlocking value through transactions or embedding sustainability across the value chain. Wherever your focus, you can trust us to bring the right mix of industry expertise, cross-functional capabilities and AI-powered solutions. We help retailers and consumer goods companies deliver meaningful and sustainable results, from start to finish.

Explore more

CEO interview: Absolute Collagen

Creating customer loyalty and taking a data-driven approach

The Consumer Reconsidered

What influences healthcare buying decisions and where are the opportunities for brands?

Your outcomes

With our insight, expertise and technology, we help you move forward, faster

Contact us

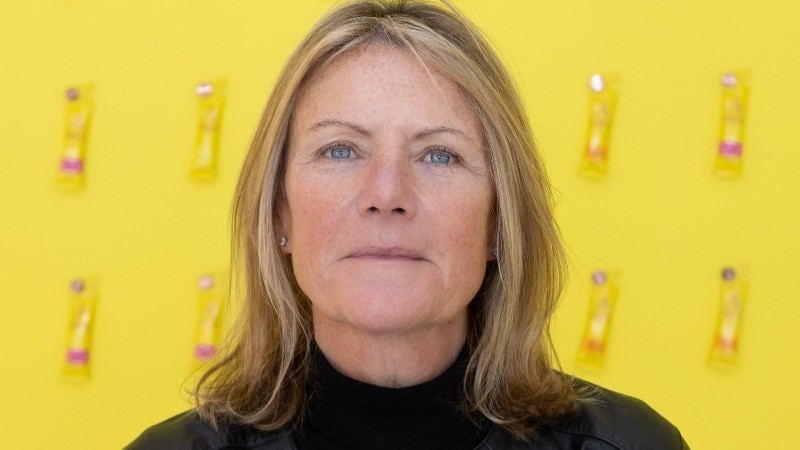

UK Head of Retail and Strategy& Partner, PwC United Kingdom

Tel: +44 (0)7801 074739

Leader of Industry for Consumer Markets, PwC United Kingdom

Tel: +44 (0)7850 515966

Global FDD Leader and Retail, Consumer and Leisure Specialist, PwC United Kingdom

Tel: +44 (0)7802 882562