iXBRL tagging for HMRC: a simple, effective, managed service

Copy link

Link copied to clipboard

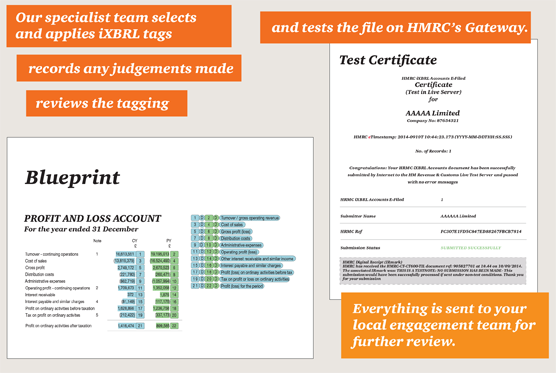

HMRC requires statutory financial statements to be filed in Inline XBRL format. We can convert your financial statements.

Our managed tagging service:

- is delivered to you by PwC people based in the UK

- generates high-quality output you need and can readily review

- averts the pain of buying and implementing new software.

Related content

Contact us

Follow us

Contact us

Hide

© 2015 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.