Pillar Two establishes a global minimum tax regime which will apply to both public and privately held multinational groups with consolidated revenue over €750m. Global agreement has been reached to bring these rules into law and the OECD has released model rules, commentary and administrative guidance.

UK legislation has been enacted which introduces the OECD’s Pillar Two model Income Inclusion Rules into UK law. The rules first apply to accounting periods commencing on or after 31 December 2023. Whilst the UK has addressed some of the issues and complexities raised in respect of the OECD model rules a number still remain. These issues and complexities are being addressed through the OECD Implementation Framework workstream (“IF”) which is releasing further Administrative Guidance on an ongoing basis. This will then be incorporated into UK legislation in due course. Therefore, it is key to track the status of implementation for both reporting and compliance purposes.

PwC's Pillar Two Engine

PwC Technology Suite for Pillar Two

- Pillar Two Engine

- Sightline

- Your Existing ERP

- Generative AI

Pillar Two Engine

Our Pillar Two Engine is a structured global model for calculating the impact of OECD Pillar Two. It simplifies modeling, analysis, and calculations, eliminating the need for manual updates for changing rules and legislation. It provides compliance and provision-grade calculations, as well as data visualisation to identify key jurisdictions where there is a risk of a Pillar Two tax requirement.

Complex, evolving regulations require dynamic, future-focused solutions.

A centralised, cloud-based calculation engine for quantifying the impact of Pillar Two, including provision, compliance, and modeling.

The Pillar Two Engine is adapted for relevant local rules and interpretations in order to meet Pillar Two requirements for global and statutory compliance, including constituent entity analysis, Transitional Safe Harbor assessments, and IIR, UTPR, and QDMTT computations and allocations.

What makes PwC’s Pillar Two Engine different

- Flexible: Supports the inconsistent and unique adoption of Pillar Two rules around the world, and evolves as required

- Iterative: Modeling accounts for multiple variations and interpretations of local rules, and allows for various data structures/sources

- Up-to-date: Dynamically updated for rule changes and new legislation in each jurisdiction using a centralised database with a vetted calculation engine

We’re happy to schedule an in-depth discussion about the Pillar Two Engine at your convenience.

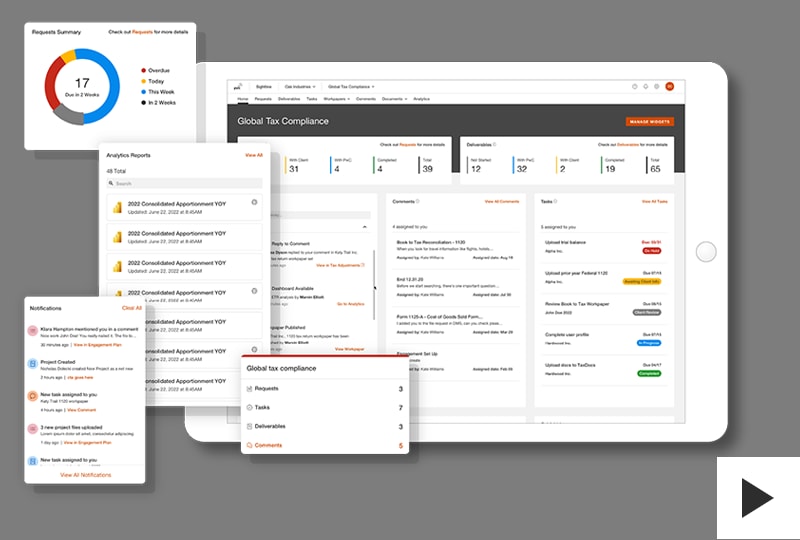

Sightline

Our Sightline tool offers transparency into your global tax processes, including Pillar Two. Around-the-clock access to securely communicate and share documents and information enables flexibility, better collaboration, and visibility across workstreams and markets.

Sightline is:

- Streamlined

Centralise global tax reporting and compliance information - Efficient

Spend less time searching for data

- Secure

Simplify communication and collaboration with secure document upload/download - Agile

Never lose sight of what’s happening, with 24/7/365 activity reporting

Your Existing ERP

By leveraging our extensive Pillar Two data expertise, your existing technology infrastructure, and our comprehensive Pillar Two Data Catalog, we can help you enhance and expand the configuration of your ERP and EPM/Consolidation systems to address your Pillar Two data challenges. These systems can also be seamlessly integrated with Sightline and our Pillar Two Engine, providing a truly unified experience.

Generative AI

AI is integrated into PwC’s Pillar Two process from data collection to interpreting countries’ global minimum tax laws. For example, we leverage AI for language translation and to help determine how local legislation differs from the OECD Model Rules in various countries. For data mapping and transformation, we use AI to validate that the correct source data has been acquired and where that data should map into the calculations.

How we can help

Assess

We help assess and model the likely financial and operational consequences of Pillar Two.

Our experience includes:

- Initial modelling to understand Pillar Two financial and process impacts on key jurisdictions

- PwC Data Input Catalog to identify required data points and build a data strategy to efficiently collect these

- Assessment of where tax department is on its transformation and technology journey

- In-depth review of whether it may be beneficial to make structural changes

- Training and upskilling your staff on Pillar Two

- Stakeholder communications

Report

We can enhance your reporting and data analytics capabilities.

Our experience includes:

- Review tax reporting process and the use of technology to automate / streamline

- Detailed modelling to provide the data for financial disclosures using PwC’s Pillar Two Engine, a centralised rules engine vetted by PwC global technical and policy leaders, producing provision and compliance grade calculations and auditable reports

- Validate deferred balances ahead of Pillar Two reporting periods

- Updates to ERP/CPM processes

- Advice on tax accounting treatment and review of disclosures

Comply

We help you meet your ongoing reporting and compliance obligations.

Our experience includes:

- Aligning Pillar Two with your existing compliance and reporting cycle using our Connected Tax Compliance approach and PwC’s Pillar Two Engine

- Support the development and configuration of modelling and compliance solutions using your existing systems (such as Oracle, SAP, OneSource, Longview etc) or your internally developed solution

- Documentation of Pillar Two related processes and controls to align with tax governance frameworks

Register to watch a recording of our recent webcast

A Practical Guide to surviving Pillar Two

Contact us

Matt Ryan

Partner, Tax, PwC United Kingdom

Matt is a senior International Tax Partner based in London with over 25 years experience delivering global solutions. Matt leads our International Tax and Treasury network and the UK frms approach to enabling clients to be Pillar Two ready. Matt is also a member of the Global Pillar Two Technical Group and the Global Structuring Group.

+44 (0)7718 981211

Contact

Partner, PwC United Kingdom

Andy is a tax partner and leads PwC Global and UK Tax Accounting Services (TAS) network. To compliment his tax reporting role, Andy is part of the UK Pillar Two leadership team, connecting with HMRC, IASB, regulators and our global network on accounting matters related to Pillar Two. Andy has reviewed safe harbour and full Pillar Two calculations on a number of clients.

+44 (0)7803 737681

Contact

Partner, PwC United Kingdom

Rob is a Tax Partner with 18 years experience working with financial services clients. Rob leads our financial services Tax Reporting and Strategy team (TRS). In this role he has worked with banks and insurers to develop their tax reporting/compliance process and implement various technology solutions.

+44 (0)7815 643891

Contact