Submitting unsecured claims in respect of potential shortfall claims from client money recovery

As clients of LBIE should already be aware from the Client Money Update published on this site on 24 May, 2012 which can be accessed here (the “Client Money Update”), the aggregate of the distributions from the client money pool may be less than the client money claim amount communicated to clients in the manner described in the Client Money Update (the “Client Money Claim Amount”). In such circumstances, client money claimants may be entitled to make an unsecured claim against LBIE in respect of any shortfall in their recovery from the client money pool.

In order to preserve all rights as an unsecured creditor, client money claimants must, to the extent that they have not already done so, submit a proof of debt by 31 July, 2012. This includes clients who (a) may have already submitted a proof of debt for an unsecured claim but, in expectation that a separate claim will be designated as a client money claim, have not submitted an unsecured claim with respect to that separate claim or any client money shortfall (b) as yet, have made no submission at all for an unsecured claim and (c) consider that they only have a client money claim.

Clients should not wait until the existence or extent of any shortfall amount has been finally determined before submitting a proof of debt in respect of a potential shortfall. However, the submission of a proof of debt encompassing a potential shortfall claim does not mean that LBIE has admitted that any individual client has an entitlement to a share in the client money pool or that an unsecured claim for any potential shortfall necessarily exists.

To submit an unsecured claim, please do so through the proof of debt which you can access via the Client Information Portal (CIP). For ease of reference, and using the pages below from the CIP as a guide, client money claimants should, to the extent that they have not already submitted an unsecured claim for the same amount elsewhere in their proof of debt, submit a claim on the CIP in one of the following ways:

Step 1

From Section 1 (‘Creditor Information’), scroll down to Section 5 (‘Statutory Requirements & General Claim Information’) and click on the ‘View’ icon which will take you to the page entitled ‘Statutory Requirements & General Claim Information’.

Step 2

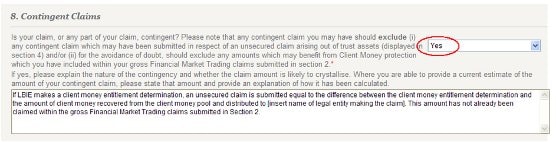

From Section 1 (‘Proprietary Rights’), scroll down to Section 8 (‘Contingent Claims’) and select ‘Yes’ should you wish to submit an unsecured claim arising from a potential shortfall from a client money entitlement.

Step 3

Within the same Section 8, in the box for explaining the nature, amount and explanation as to calculation, please state:

“If LBIE makes a client money entitlement determination, an unsecured claim is submitted equal to the difference between the client money entitlement determination and the amount of client money recovered from the client money pool and distributed to [insert name of legal entity making the claim]. This amount has not already been claimed within the gross Financial Market Trading claims submitted in Section 2”

Note: if you have already claimed for the same amount within Section 2 of the Portal ‘Claim relating to Financial Market Trading Agreements’ then there is no requirement to complete Steps 1 - 3 for the amount already claimed within Section 2.

If you are unsure about any aspect of the procedure for preserving possible shortfall claims, you should consider seeking legal advice. You may also contact the LBIE Communications and Counterparty Management team here.