Submitting unsecured claims in respect of potential shortfall claims from trust asset returns

As clients of LBIE should already be aware from the Trust Assets Update published on this site on 25 March, 2010, the Administration has been working with trust asset claimants to reconcile claims and return trust assets. The aggregate of the returned trust assets, together with any distributions derived from the trust assets, may be less than the total amount which trust asset claimants believe is due to be returned. In such circumstances, trust asset claimants may be entitled to make an unsecured claim against LBIE in respect of any trust assets that are not returned.

In order to preserve all rights to participate in the general estate as an unsecured creditor, trust asset claimants must, to the extent that they have not already done so, submit a proof of debt by 31 July, 2012. This includes trust asset claimants who may have already submitted a proof of debt for part of their claim and trust asset claimants who, as yet, have made no submission. This also includes trust asset claimants who consider that they have a client money claim, arising from the payment of distributions in respect of trust assets, and that a potential shortfall may arise in respect of such claim.

Trust asset claimants should not wait until the recovery and return of the trust asset reveals the existence or extent of any shortfall before submitting a proof of debt in respect of a potential shortfall. However, the submission of a proof of debt encompassing a potential shortfall claim will not be determinative as to whether the shortfall claim will be accepted. LBIE has not admitted that any individual client has an entitlement to an unsecured claim for any potential shortfall.

To submit an unsecured claim, please do so through the proof of debt which you can access via the Client Information Portal (CIP). For ease of reference, and using the pages below from the CIP as a guide, trust asset claimants should, to the extent that they have not already submitted an unsecured claim for the same amount elsewhere in their proof of debt, submit a claim on the CIP in one of the following ways:

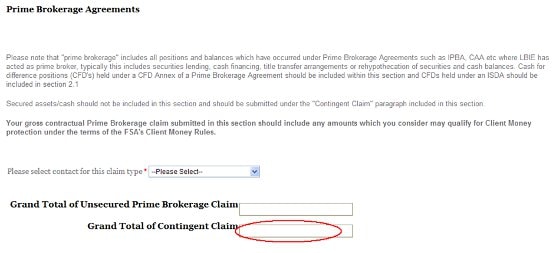

A. For trust asset claim(s) arising under Prime Brokerage Agreement(s):

The Guidance Notes to the Unsecured Portal set out what positions and transactions should be included in the Prime Brokerage Agreement section. If your trust asset claim should be included in the Prime Brokerage Agreement Section then please follow these steps:

Step 1

On the ‘Welcome’ page, press ‘Continue’ to go to the main Proof of Debt screen. From Section 1 (‘Creditor Information’), scroll down to Section 2 (‘Claim relating to Financial Market Trading Agreements’) and click on the ‘Edit’ icon in Section 2.3 (‘Prime Brokerage Agreements’) which will take you to the relevant screen.

Step 2

If a Prime Brokerage Agreement has not previously been added to this section then click on the “Add Prime Brokerage Agreement’ button and insert the relevant agreement details (for more detailed information please see the Unsecured Portal Guidance Notes).

Next, click on the ‘Agreement ID’ of the relevant agreement to open the ‘Details’ screen, scroll down to ‘Contingent Claim’ and state the amount accordingly for positions arising under that agreement.

Repeat this step for each Prime Brokerage Agreement where you would like to state a Contingent Claim amount. In the event that your Contingent Claim relates to positions that do not arise under Prime Brokerage Agreements please do not complete this section and go to ‘B’ below.

The sum of the Contingent Claim(s) entered by you for each applicable Prime Brokerage Agreement will be automatically populated in the Prime Brokerage Agreements summary section in ‘Grand Total of Contingent Claim’.

Step 3

Return to the main Proof of Debt page and, from Section 1 (‘Creditor Information’), scroll down to Section 4 (‘Unsecured Claims arising out of Trust Assets’) and check that the amount automatically populated following Step 2 is correctly stated and replicates the amount populated in ‘Grand Total of Contingent Claim’ in Section 2.3 (‘Prime Brokerage Agreements’).

B. For trust asset claim(s) arising other than under Prime Brokerage Agreements

This step should be completed in the event that you believe that you have an unsecured claim arising from trust asset claims which are not within Section 2.3 (‘Prime Brokerage Agreements’) of this Proof of Debt.

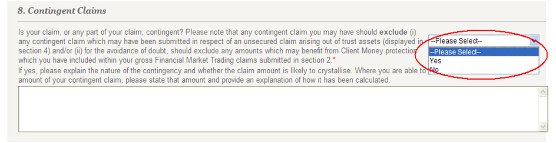

Step 1

To complete this step, on the ‘Welcome’ page, press ‘Continue’ to go to the main Proof of Debt screen. From Section 1 (‘Creditor Information’), scroll down to Section 5 (‘Statutory Requirements & General Claim Information’) and click on the ‘View’ icon which will take you to the relevant screen. From Section 1 (‘Proprietary Rights’), scroll down to Section 8 (‘Contingent Claims’) and select ‘Yes’.

Step 2

Within Section 8, in the box for explaining the nature, amount and explanation as to calculation, please state the amount in GBP of the unsecured claim relating to Trust Asset Claims (other than Prime Brokerage), how this figure has been calculated and the circumstances under which this amount is claimed for.

Note: if you have already claimed for the same amount within Section 4 of the Unsecured Portal (‘Unsecured Claims arising out of Trust Assets’) then there is no requirement to complete Section 8 for the amount already claimed.

C. For trust asset claims arising under both Prime Brokerage Agreements and otherwise

If you have trust assets claims arising under Prime Brokerage Agreements and, separately, another basis, then you should complete the steps outlined within both of paragraphs ‘A’ and ‘B’ (above), ensuring that the same amount is not duplicated.

If you are unsure about any aspect of the procedure for preserving possible shortfall claims, you should consider seeking legal advice. You may also contact the LBIE Communications and Counterparty Management team here.