The London Market is undergoing significant change. Investments are being made as insurers decide how and where to position themselves for long-term profitable growth.

Built on expertise, the London Market is specialist. While traditionally technology has not been a differentiator, this is changing at pace.

We asked senior management of London Market insurers their opinions on the drivers, opportunities and risks of technology investments. Our survey revealed unique insights on delivering successful transformation and getting the best return on investments.

Insurers’ ambitions for change

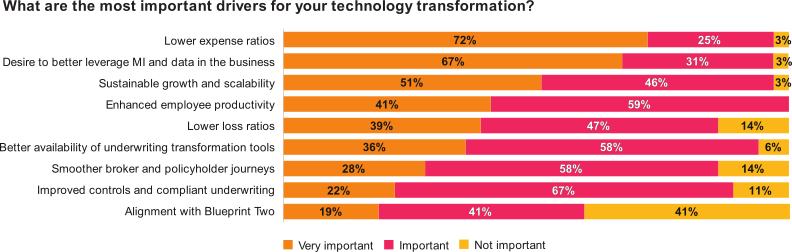

London Market insurers are trying to solve a wide range of problems simultaneously. They need to better equip underwriters with the right tools and insight; lower costs and drive productivity; improve controls and better serve clients and brokers.

They also have an expense problem, collectively and individually, the survey finds to be the top driver they are looking to address.

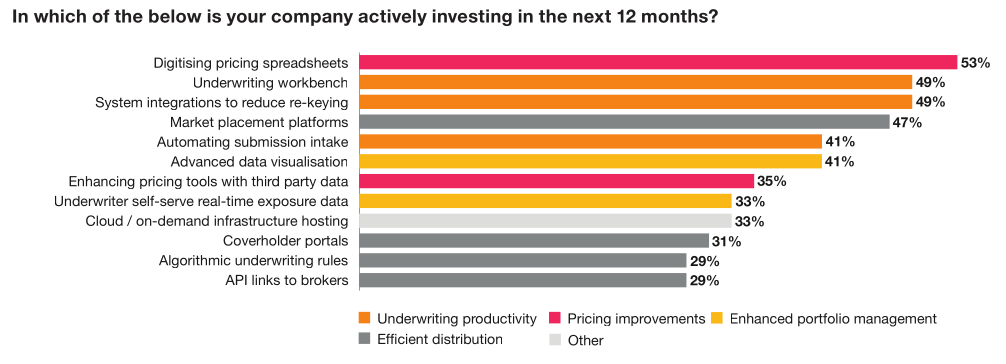

Initiatives and tooling

Insurers show ambition in the breadth of their technology change: a third are investing in more than four tools simultaneously.

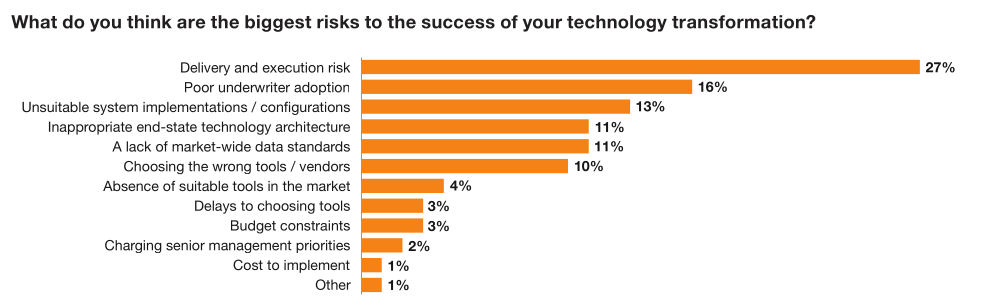

Risks and dependencies

Deploying new technology needs to carefully balance risk. Many insurers spend a lot of money but fail to deliver on the business case.

What to do next

- Confirm your business strategy is leading your technology transformation

- Set clear, realistic objectives aligned to the business case for your transformation

- Set out a target state technology design for your business

- Ensure any technology investment is aligned with cultural change programmes and hybrid working efforts

- Combine any new technology with robust business processes

- Adopt new common data standards

“London’s continued success as a global insurance hub depends on successful digital transformation. The market is collectively investing more than a billion pounds in digitisation, to deliver efficiency gains and better service to brokers and clients.”

Andy Moore,

London Market Lead, PwC UK

Contact us