UK could remain a top-10 global economy in 2050 - despite Brexit

- UK could be the fastest growing G7 economy up to 2050, with average annual growth of 1.9%

- Remaining open to talented workers and developing successful trade links with fast-growing emerging economies will be critical to realising the UK’s long-term growth potential

- World economy projected to double by 2042, growing at average annual rate of 2.5% to 2050

- By 2050, six of the seven world’s largest economies will be emerging markets - led by China

- India could overtake US as world’s second largest economy, with Indonesia in fourth place

- EU27’s share of world GDP could fall below 10% by 2050 - France out of the top-10 and Italy out of top 20

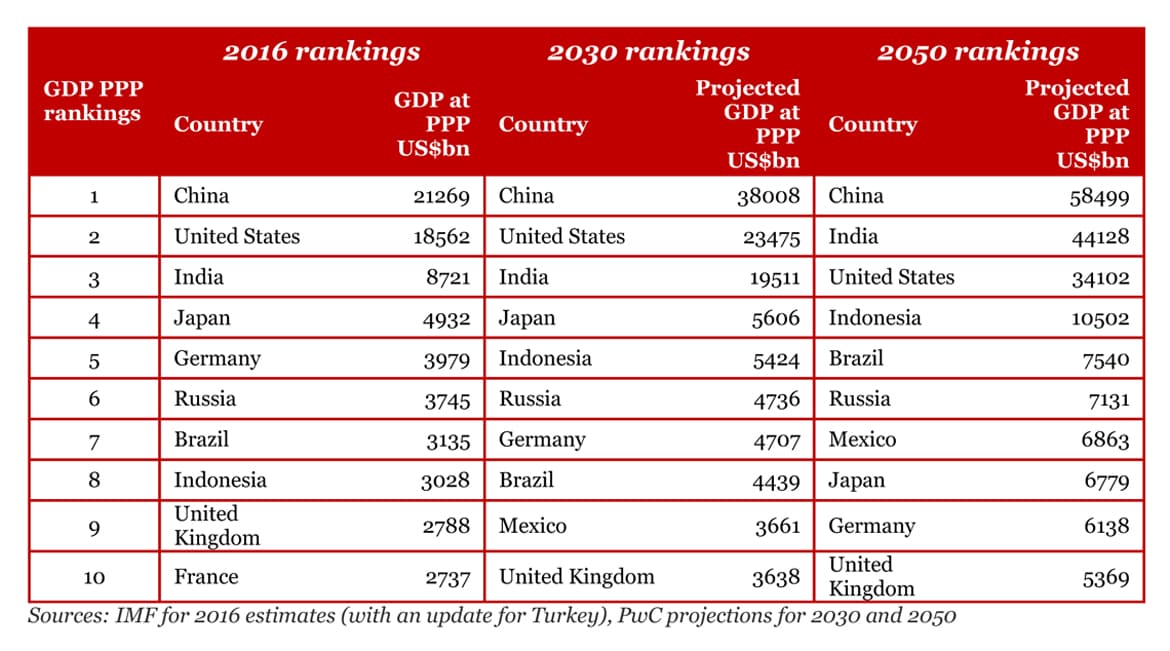

The UK’s long-term economic growth could outpace leading EU countries like Germany, France and Italy, even despite some medium-term drag from Brexit, according to new analysis by PwC. PwC’s The World in 2050 report forecasts that by 2050, the UK will have fallen by just one place from 9th to 10th in global economy rankings, measured by purchasing power parity (PPP) [see Notes for PPP definition].

If measured instead by GDP at market exchange rates, the UK could fall from 5th to 9th place by 2050, but by either measure will remain a top-10 global economy. With potential average annual growth of around 1.9%, the UK is projected to remain the fastest growing economy in the G7 between 2016 and 2050. The UK’s position is sustained by its projected larger working-age share of the population than in most other advanced economies. However, PwC cautions that this strong growth potential depends on the UK continuing to attract and employ talented people from around the world, even after it leaves the EU.

Commenting on the forecast, John Hawksworth, chief economist at PwC, said:

“After a year of major political shocks including the EU referendum and the election of President Trump, it might seem brave to offer economic prospects for 2017, let alone 2050.

“But a long-term view is crucial for planning for issues like pensions, healthcare, energy and climate change, housing, transport and other infrastructure investment. By looking beyond unpredictable short-term economic and political cycles and focusing on fundamentals, long-term growth projections can actually be more reliable than short-term forecasts.

“Our relatively positive long-term growth projection for the UK reflects favourable demographic factors and a relatively flexible economy, even by European standards.

“However, developing successful trade and investment links with faster-growing emerging economies and recruiting workforce talent wherever in the world it can be found, are essential to achieving this growth and to offset probable weaker trade links with the EU after Brexit.”

PwC emphasises the importance of building strong political and trading relationships with new, emerging economies. Regardless of the outcome of the EU referendum, these economies were going to become dominant global economic forces, eclipsing many EU members and therefore essential to the UK’s ultimate long-term economic growth.

China has already overtaken the USA to become the world’s largest economy in PPP terms and will move further ahead by 2050. India currently sits in third place and is projected to overtake the US by 2050.

By 2050, Indonesia is expected to have moved up the rankings to fourth place, overtaking not just Germany and Japan but also Brazil and Russia. Germany and the UK remain in the top-10, but France falls to 12th place and Italy to 21st as it is overtaken by a succession of faster-growing emerging economies like Vietnam.

PwC projects that the world economy will double in size by 2042, growing at an average annual rate of just over 2.5% between 2016 and 2050, with growth expected to be driven largely by emerging market and developing countries. The E7 economies of Brazil, China, India, Indonesia, Mexico, Russia and Turkey are forecast to grow at an annual average rate of 3.5% over the next 34 years, compared to an average of just 1.6% for the advanced G7 nations of the US, Canada, France, Germany, Italy, the UK and Japan.

According to PwC, that means that the E7 could comprise almost 50% of world GDP at PPPs by 2050, while the G7’s share could decline to just over 20%. But emerging economy growth will also slow down over the period, as these economies mature and the scope for relatively easy ‘catch-up growth’ by importing advanced economy technologies is reduced over time.

PwC says these global shifts in economic power provide key policy messages for the UK and its devolved regions. Assuming continued access to EU markets post-Brexit, and ignoring the opportunities - and the challenges - offered by emerging markets would be a mistake. Even if the UK had voted to remain in the EU, it would have been necessary to look to these emerging markets for the next wave of growth.

The relative shift in the position of the global top-10 economies between 2016 and 2050 is summarised below:

Projected global GDP rankings in PPP terms (US $bn at constant 2016 values)

John Hawksworth said that the global economy faces a number of long-term challenges to prosperous economic growth:

“Ageing populations and climate change require forward-thinking policies, which equip the workforce to continue to make societal contributions later on in life and promote sustainable development. Falling global trade growth, rising inequality and increasing global uncertainties are intensifying the need to create diversified economies that offer opportunities for everyone in a broad variety of industries.

“Emerging economies offer great opportunities for business and the forecasts in our report make it clear that failure to engage with these markets means missing out on the bulk of the economic growth we expect to see in the world economy between now and 2050.”

Ends.

Notes for editors.

About the report

1. PwC’s latest World in 2050 report projects GDP to 2050 for 32 of the largest economies in the world, which together, currently account for around 85% of global GDP. PwC’s model accounts for projected trends in demographics, capital investment, education levels and technological progress to estimate trend growth rates. This long-term growth model was first developed in 2006 and has been updated periodically since then, most recently in 2015.

Projected global GDP rankings in PPP terms (US $bn at constant 2016 values)

1. The full report entitled The long view: how will the global economic order change by 2050? is available online from 7th February 2017 at: http://www.pwc.com/world2050

2. Purchasing power parity (PPP) estimates of GDP adjust for price level differences across countries, providing a better measure of the volume of goods and services produced by an economy as compared to GDP at current market exchange rates, which is a measure of value. The report focuses primarily on the PPP measure, but also includes projections for GDP at market exchange rates (MERs).

3. The analysis assumes the main economic impact of Brexit occurs over the period to 2020, based on latest IMF medium-term projections for UK GDP growth. After 2020, UK growth is assumed to revert to its long-term trend as determined by the fundamentals of working age population growth, investment in human and physical capital, and technological progress.

4. For a shorter term view of global economic prospects and risks, see PwC’s 2017 Global CEO Survey which suggests that 89% of UK CEOs are confident of their company’s growth over the next 12 months, compared to a global figure of 85%.