Front of mind for the UK's new prime minister will be the impact of geopolitical changes and the rising cost of living on the outlook for gross domestic product (GDP) growth, inflation, and the shape of economic recession. Our latest outlook explores this in detail, and looks at where future economic growth could come from.

Recent economic performance

In June 2022, the UK economy shrank by 0.6%, with polarised growth recorded at regional levels. While economic output stood at 0.9% above its pre-pandemic level in February 2020, some regions struggled to breakthrough beyond the pre-pandemic levels, deepening the regional growth imbalance.

Latest data shows London growing at the fastest rate (in Q3 2021), while other regions, such as the North East, the Midlands and Wales, experienced a contraction of between 1.2% and 0.3%, and remain around 3.3% smaller than pre-pandemic levels.

UK growth outlook

The growth outlook for the UK has deteriorated. Over 2022, we expect UK GDP growth to average between 3.1% and 3.6%, followed by two years of slow, or even negative, GDP growth.

Projected annual average real UK GDP growth, by scenario

Our model predicts the UK to enter a recession as early as this year. This is largely due to surges in inflation as the cost of living crisis impacts all demographic groups. However, the shape of any recession is more important to businesses and policy makers than whether a recession is recorded in the national accounts.

The UK inflation outlook is highly uncertain. Our scenario analysis suggests headline inflation could peak at 17% in the first half of 2023. But if the government chooses to freeze household energy bills, then this could see inflation peak at between 10% to 13%.

A peak inflation rate of 17% would be the highest rate since 1980. Annual CPI inflation, illustrative projections based on changes to energy futures prices

UK productivity

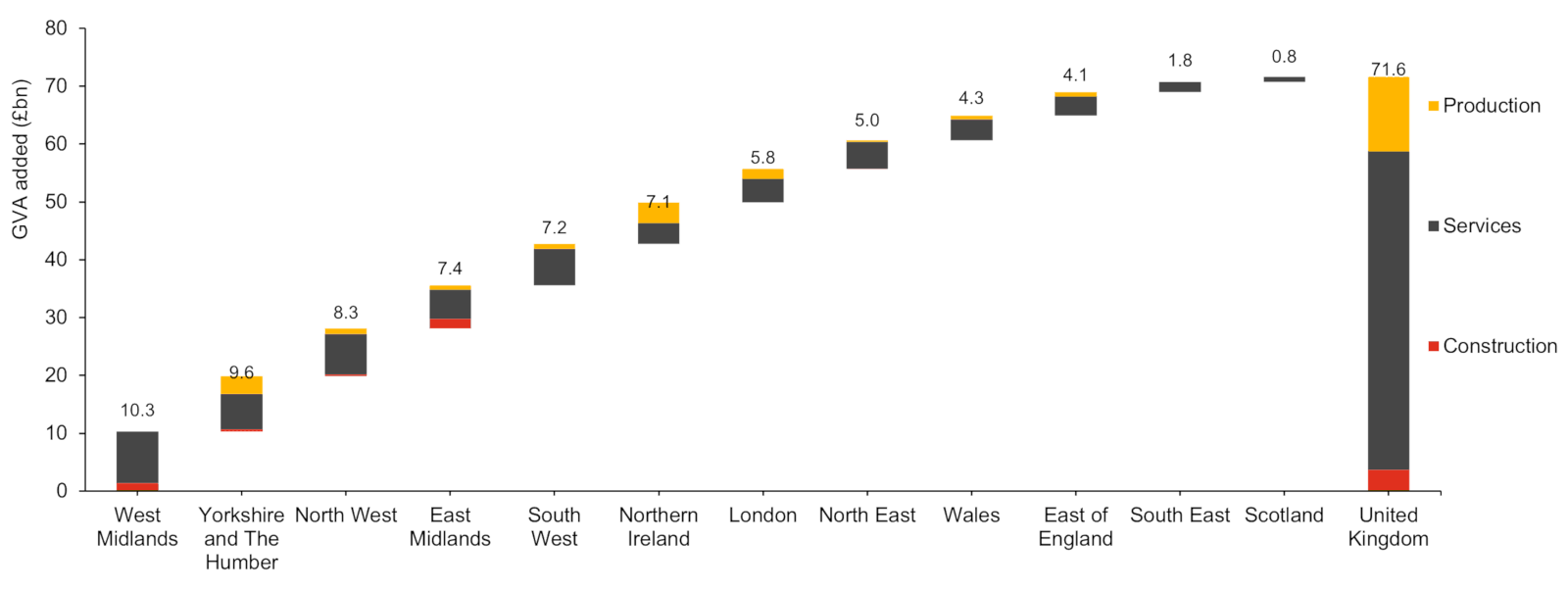

UK productivity gaps have been persistent, but improving sectoral productivity in some regions - to at least the industry’s median levels - could add £71.6bn to the UK output in 2023.

Closing regional productivity gap could add around £71.6bn to the UK total GDP. Impact on regional GVA (£bn) if lagging regions raise their productivity to the industry’s median level, 2023

London and the South East are the only two regions that exceeded the average UK productivity levels, making closing the regional productivity gap more crucial to the levelling up strategy as well as the overall economic growth. Our analysis suggests industry composition, variations in skills levels and labour activity are the most important factors in explaining differences in productivity across UK regional areas and so should be a particular focus of investment for both government and business.

Where will future growth come from?

Regardless of political stance, all agree economic growth is desirable - the challenge is how to pursue it against the backdrop of ongoing geopolitical uncertainty, stagflation, productivity gaps, and cost of living crisis.

We believe substantial and sustainable growth for the UK economy could lie in the following ten areas:

Amid unprecedented levels of uncertainty at both global and national levels, there is no quick fix for the series of tough challenges the UK's new prime minister is facing. To deliver an ambition in which an economically strong and a more sustainable economy is a reality, the Government could consider focusing policy on the areas discussed in this report.

To explore the full analysis, download our September 2022 UK Economic Outlook.

Contact us