Expert guidance in a dynamic world

PwC is the UK's leading tax service provider in terms of reputation, size and scope. We work with a diverse range of clients, including multinationals, public sector bodies, entrepreneurs, and family businesses. In today’s fast changing tax landscape where staying ahead is crucial, our team of experts can help your tax department adapt to future proof your business.

“We partner closely with our clients across a broad range of tax advisory and compliance services, supporting them to navigate complex tax environments. Our diverse team of specialists bring together leading-edge technology with deep technical expertise to provide tailored, high-quality advice and insights to solve our clients' most complex problems.”

Featured content

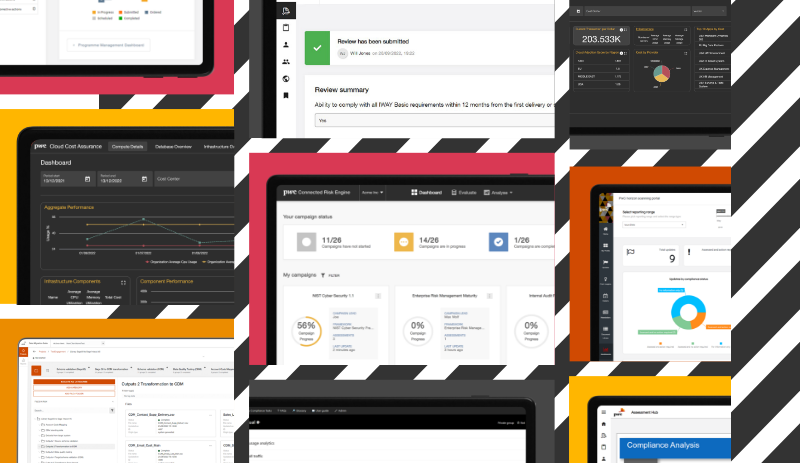

Digital store

Today’s world is fast-moving, uncertain and unpredictable. Our digital products have been built to help better understand and navigate your business issues so that you can adapt and grow in the face of disruption.

Knowledge Navigator

Access extensive news, tools, and services to help you manage your Tax obligations more effectively. Stay updated on new developments, mitigate risks, boost productivity, and access in-depth research modules—all with a subscription plan that fits your needs.

Contact us