BankLab™ can help you answer questions like:

- How many branches does a bank have in Spain? Do they have a local partnership in place?

- Is a bank present in China? What products do they offer?

- Which types of banking instruments exist in Brazil?

- Can you implement domestic or cross-border cash pooling in Croatia in local or foreign currency?

About BankLab™ Solution

Helping clients with their cash management, we find three specific challenges:

- 1. Do you understand your bank spend?

- 2. Do you use spreadsheets to gather information for banking tenders and analyse bank’s responses?

- 3. Are you able to quickly access Information on what cash management options you have in a country?

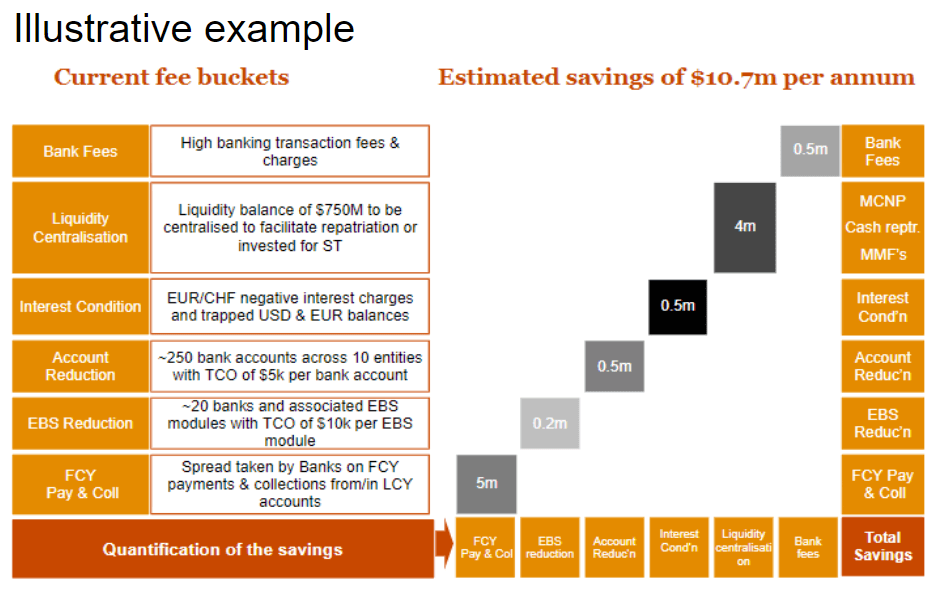

1. Do you understand your bank spend?

The challenge is that fees are not invoiced by the bank, nor do banks report fees in a way that make it possible to compare fees charged by two banks on a like-for-like basis.

Once you manage to reconcile the fees, you may find that bank fees are often twice as high as expected and you have used more expensive payment services e.g. CHAPS rather than BACS or had more payment file repairs leading to higher costs.

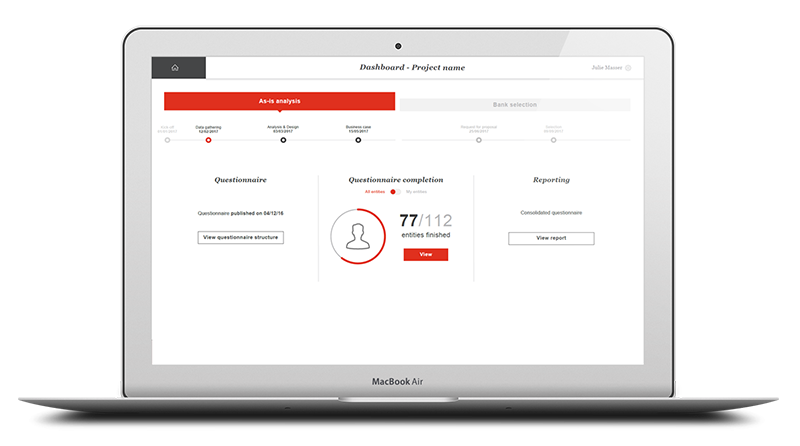

2. Do you use spreadsheets to gather information for banking tenders and analyse bank’s responses?

Cash managers often rely on spreadsheets for cash management. Therefore, gathering information, e.g. what banking services are used, what volume of transactions exist and what are the current prices, which is needed for a banking RFP can be difficult. Also, the bank RFP process (issuing, responding and scoring) is often undertaken in spreadsheets

PwC have found that there are significant benefits in using data analytics tools Instead of spreadsheets during the bank tender process.

3. Are you able to quickly access Information on what cash management options you have in a country?

When you want to arrange or replace cash management in a specific country, you often have to rely on a multitude of different sources to gather the necessary market insight on things like: what banking options you have, what services are available and how to integrate the country into your existing cash concentration setup.

Based on our experience of working with clients and our extensive insight into cash management around the globe, we developed BankLab to help you reduce your bank spend and optimise banking and cash management setup.

BankLab™ can help in three essential ways:

BankLab™ has helped us deliver these benefits:

Improved cost visibility

- Actual bank cost identified.

- True cost often significantly more than expected – more savings identified.

Bigger benefits

- 20-70% savings achievable.

- Scenario analysis of options.

Better liquidity management

- Up to date market insight for decision making.

- Reduction in the number of bank accounts.

- Improved free cash flow.

More efficient process

- Online information gathering.

- Flexible data analytics.

Contact us

Partner, Head UK Treasury and Commodities, PwC United Kingdom

Tel: +44 (0)7720 430125