Employee Ownership Trusts

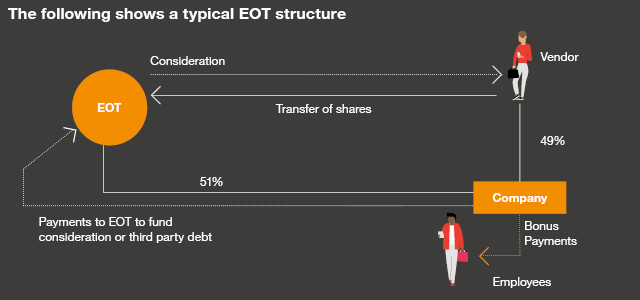

Employee Ownership Trusts (EOTs) are a Government initiative aimed to promote employee ownership by giving business owners the opportunity to sell their shares to an employee owned trust free from capital gains tax. EOTs do not involve direct share ownership by employees, rather a controlling interest in company is transferred to an all-employee trust which is then held for the benefit of employees.

Why might you use an EOT?

EOT structures and funding

On setting up an EOT, funding will be required in order to allow the purchase of shares from the existing owners. The vendor will often be paid for their shares out of future income generated by the Company.

How can PwC help?

PwC can assist with all aspects of the implementation of an Employee Ownership Trust.

< Back

< Back

[+] Read More

Contact us