Resilience expectations are high

While the UK public say they don’t consciously consider resilience in their dealings with business and government, when considering past, present and future disruptive events, their expectations of organisations and government resilience are high. That’s according to our deliberative research with a cross section of the UK public from different demographics and backgrounds, conducted by Jigsaw Research.

Jigsaw Research ran two workshops on 28 and 30 November 2022 in Sheffield and London. There were 21 adult participants in each session, with a mix of ages and life stage, other demographics and attitudes to risk. Our aim was to find out what resilience means to the UK public and how they view the resilience of businesses and wider society.

People acknowledged that we have had to deal with a string of ‘crises’ in recent times. And there’s no clear end in sight.

People expect government to ensure the UK’s infrastructure is resilient and to keep organisations and society afloat, no matter what the extent of the shock or threat, with recent experience during the pandemic reinforcing that view. And people also say they expect reputable businesses to protect consumers by running their organisations competently – including looking ahead, understanding where they are exposed and being ready for disruptive events.

These high expectations of the public - as consumers, employees and citizens - mean any gaps in resilience and a failure by businesses and government organisations to deal with disruption, will impact negatively on reputation and trust.

Building resilience and the impact on reputation and trust

Along with high expectations of resilience, there is also consensus among the public that organisations need to be able to adapt to disruption. Planning and preparing can only take you so far and the ability to flex and weather storms can be as important as situations are often fluid. This sentiment is universal and also applicable to how both businesses and government approach resilience.

People are also generally willing to take some steps to bolster their own resilience but need to have both the motivation and means to do so. Motivation tends to be higher when people have a greater sense of agency.

Our research also found that people are more likely to avoid an organisation because of a perception of poor ethical practices than because of a perception of lack of resilience. At the same time, poor ethical practices have a clear link with resilience through an organisation’s ESG strategy.

Organisations with a robust ESG strategy are also likely to be more resilient through more sustainable practices and stronger governance. Investment research company Morningstar found that 24 out of 26 sustainable index funds it examined held up better during the initial pandemic outbreak in 2020 and outperformed conventional counterparts. The study shows how companies that deal with their environmental challenges, treat stakeholders well and govern themselves ethically are more resilient during a sudden crisis.[1]

The risks of most concern to the UK public

The findings of our annual survey of 2,000 UK adults, conducted by Opinium in August 2022, shows a major shift over the past 12 months in the risks people are most concerned about and that will have an impact on their daily lives, from the pandemic and other health crises to financial worries.

Amid the highest inflation since the early 1980s and spiralling energy bills the UK public is increasingly worried about the cost of living crisis, with 86% of people concerned about day-to-day living costs - and just over half (54%) saying they are very concerned.

In response to these growing financial concerns, which include rising inflation, increased taxes and potential recession, people are already taking measures to save money and cut back on unnecessary expenditure - particularly younger people in the 18-34 year old age group, who appear to be feeling the impact of the cost of living crisis more acutely.

With the ongoing war in Ukraine and other geopolitical tensions causing uncertainty and disruption, global conflict and unrest have also risen up the list of people’s concerns.

And while there has been an overwhelming shift to financial issues in this year’s survey, other key issues such as climate change, cyber crime and the availability of public services all still feature among the public’s top 10 concerns for 2022.

The issues that will impact daily life the most over the next year

The UK public expects financial pressures to impact them the most over the next 12 months, with day to day living costs, potential recession and increased taxes topping the list of issues survey respondents say will have an impact on their daily lives.

Just over half (54%) of all UK adults say day to day living costs will have a high or very high impact on their daily lives over the next 12 months but other financial pressures aren’t felt evenly across all age groups, with 18-34 year olds anticipating the greatest impact. For example, just under half (48%) of 18-34 year olds say a potential recession will have a high or very high impact on their daily life over the next year, compared to just over a third (36%) of over 55s. And 48% of 18-34 year olds say increased taxes will have a high or very high impact on them, compared to just over a quarter (27%) of over 55s.

How the cost of living crisis is shaping people’s behaviours and spending habits

As people’s financial pressures and worries grow, the survey indicates the UK public are paying more attention to their personal financial resilience and wellbeing, with people cutting back on activities such as holidays, leisure and shopping.

To save money, 46% of people say they have already stopped or reduced the amount they eat out and 34% are shopping at a cheaper supermarket. And looking ahead, 39% of UK adults say they expect to go out less in the evenings over the next year, 41% expect to travel abroad less, while 35% say they plan to spend less on clothes. The intention to travel overseas less could be a combination of cost and disruption, as the survey was carried out amid the airport travel problems during the summer of 2022. Other things people are already reducing or stopping to save money include holidays (48%) and TV/streaming subscriptions (45%).

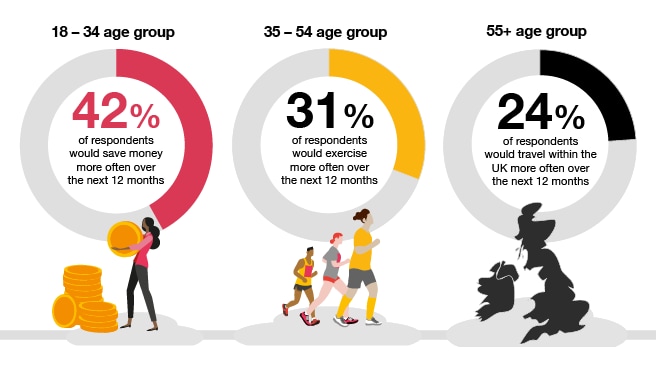

The younger 18-34 age group is responding to these cost of living concerns in more pronounced ways than older groups, including:

Saving money

Significantly more 18-34 year olds (42%) plan to save money more in the next 12 months, compared to 27% of all adults and 15% of over 55s.

Learn about personal finance

Far more 18-34 year olds (38%) plan to learn more about personal finance over the next year, compared to 25% of 35-54 year olds and 13% of over 55s.

Younger people are cutting back more on:

Holidays

58% of 18-34 year olds are already reducing or stopping going on holiday, compared to 37% of over 55s.

Eating out

69% of 18-34 year olds are reducing or stopping eating out, compared to 51% of over 55s.

TV/streaming subscriptions

57% of 18-34 year-olds are reducing or cancelling their subscriptions, compared to just 28% of over 55s.

Job security versus salary expectations

While 58% of respondents across all age groups say they would take a more secure job that pays less in the current environment, just over half (51%) of 18-34 year olds say they would take a job that pays more over security, suggesting younger people are putting a higher value on ‘ready money’ over job security or satisfaction.

And just over half (51%) of the over 55 age group say they value job satisfaction over security, which suggests they are under less financial stress and can prioritise doing work they enjoy over security or money.

Health and wellbeing

Despite their other financial pressures and cutting back spending, younger people are still prioritising health and wellbeing through exercise, fitness and nutrition.

While 31% of all respondents say they expect to do more exercise in the next 12 months, this is highest for the 18-34 age group (39%) versus 31% of 35–54 year olds and just 24% of those who are 55 and over.

Significantly more 18-34 year olds (33%) also plan to spend more on fitness in the next 12 months than any other age group, compared with 20% of overall respondents and just 12% of over 55s - however, 53% of 18-34 year olds who currently have gym memberships also say they are already reducing or cancelling these. Rather than being indicative of younger people going to the gym less it could be that they are simply seeking cheaper gym memberships, or are spending more on other areas of fitness and exercise.

When it comes to what they eat, more 18-34 year olds (38%) plan to spend more on fresh food (fruit and veg) in the next 12 months than other age groups and a third (33%) of 18-34 also plan to spend more on health supplements compared to 15% of 35-54 year olds and 8% of those who are 55 and over.

Younger people - more risk averse but also more resilient?

More than a third (35%) of all respondents say they are more risk averse in their lives as a result of the pandemic, but the impact would appear to be greater on younger people with 50% of 18-34 year olds saying they are now more risk averse.

And just over a third (35%) of all respondents also say they feel more resilient and able to ‘bounce back’ because of the experiences of the last three years. This jumps to 48% for 18-34 year olds, and perhaps the intended changing behaviours of this age group to reduce spending and save money in response to the cost of living crisis accounts for this resilience.

“Businesses have an important role in helping address the growing range of risks we face today and their actions will be scrutinised more than ever before. The UK public increasingly expects organisations to support their customers and employees through these challenging times, and being seen to not be ‘doing the right thing’ could have a damaging impact on trust and reputation.”

Bobbie Ramsden-Knowles, Crisis and Resilience Partner, PwC UK

What do these changing public behaviours and attitudes mean for organisations?

When asked who is responsible for mitigating these top risks and concerns that will impact people’s daily lives over the next year, government (51%) remains the highest response but this is actually down year-on-year by 8%. By contrast the UK public increasingly think businesses are responsible for mitigating risk - up to 33% from 24% in last year's survey. This shift could be because people think businesses are best placed to help them weather the financial crisis through increased wages and job security, which are more under the control of employers than government. This is a shift from last year’s survey when the role governments had played in the response to COVID-19 was very topical.

The survey results also highlight that for an organisation to be resilient it must be agile and adapt to the fast-changing and unpredictable nature of risk - in this case health and financial concerns - given how these risks can quickly drive a change in people's behaviours and spending habits.

To illustrate how fast-changing these concerns are, contrast these results with this year’s UK CEO Survey - carried out before the Ukraine conflict and the energy crisis - where UK CEOs said their top concerns are cyber crime, health, macroeconomic volatility and climate change. Almost three-quarters (73%) of CEOs also said they believed the UK economy would improve in the next 12 months.

This research shows behaviours of the public rapidly shifting - particularly younger people - in response to these cost of living pressures. For example, TV and streaming services boomed during the pandemic while people were stuck at home and had limited options for entertainment, but now people are cutting back on these subscriptions as the cost of living crisis bites. Our research highlights how organisations need to rethink their approach to risk and resilience so they can respond quickly to crises and events to mitigate a sudden change in public and consumer behaviour.

Contact us

Risk and Resilience Partner, PwC United Kingdom

Tel: +44 (0)7483 422701