Our business model

We believe in walking the talk, and applying the same advice we give to our clients to ourselves, wherever it’s applicable. One such area is integrated reporting, where we’ve supported both the Integrated International Reporting Council and clients to explore new ways of describing business performance.

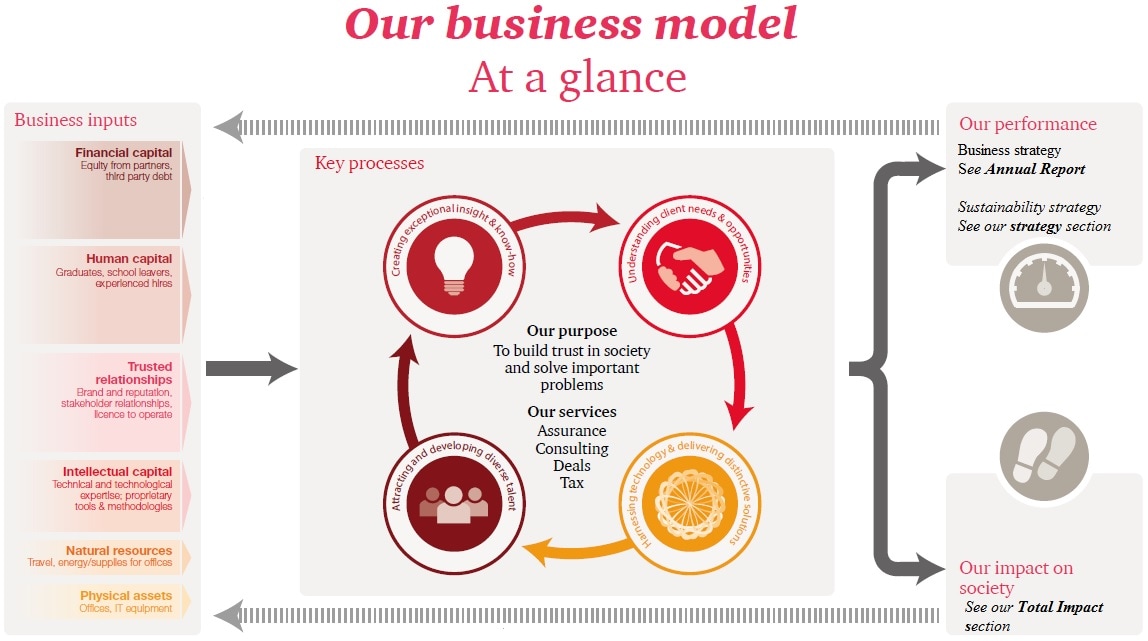

So, as recommended by the International Integrated Reporting Framework we set out our business model (see diagram below), with its inputs, strategic processes, and outputs. It describes how we create value for our stakeholders through our core processes, and delivering on our purpose. Our description also recognises the interdependencies between our business and the wider context i.e. we rely on a range of inputs including human, social and natural capital and our business has a range of impacts on society that go beyond our financial performance. The inputs are covered in more detail below, and our impacts are explained in our total impact analysis.

Our inputs

We have a diversified business with a wide range of clients across a variety of industries. As a people-based organisation, our primary external input is human capital. We also draw on a bank of financial, intellectual and social capital that we build up through our operations, and we require some, limited, environmental resources and manufactured assets to run our operations.

Four strategic processes

At the heart of our business model are four strategic processes which create a virtuous circle of responsible, profitable growth.

1. Attracting and developing diverse talent

We recruit, train, develop and motivate talent from diverse backgrounds, to create an agile workforce that can offer solutions for our clients and other stakeholders, focused on assurance, tax, deals and consulting services. Being a progressive employer that offers exceptional career and development opportunities gives us competitive advantage.

2. Creating exceptional insight and know-how

We anticipate market trends and identify areas where we can invest to ensure our points of view, methodologies, technology, and technical know-how address the risks and opportunities facing industries, our clients and society. Our structure – a partnership - encourages a culture of entrepreneurship and innovation and we make the capture and sharing of knowledge a priority for all our people. When appropriate, we acquire companies with specific expertise that fills gaps in our existing portfolio.

3. Understanding client needs and opportunities

We take time to really understand our clients, in the private, public and voluntary sectors, listening to them closely. We differentiate ourselves by focusing on the value they’re looking for, and having a strong, global network with deep roots and local knowledge wherever they need it. Our focus on trusted, collaborative partnerships extends to our stakeholders, including our suppliers and community partners. It’s part of our culture and our common set of values, including personal responsibility and doing the right thing.

4. Harnessing technology and delivering distinctive solutions

We assemble the right people and know-how to deliver a ‘One Firm’, distinctive service (the ‘PwC Experience’) to help our clients comply with regulations, manage and reduce risks, or seize new opportunities. Our solutions draw on talent from any of our lines of service, anywhere in the UK or from our network of territories around the world. Increasingly, we’re applying technology as a game changer, to create new solutions, or significantly enhance existing ones.

This creates financial capital which is reinvested in the business, or distributed to our partners, whilst additional value is created for our other stakeholders. The outputs of our strategic processes are our business performance and the net impact of our activities on society.

Our performance

We report extensively on our business and financial performance in our Annual Report. This includes our accounts and a balanced set of non-financial information in a dedicated sustainability scorecard which covers the issues on our sustainability materiality matrix. You can find out more about these ‘outputs’ of our business in the ‘Focus areas’ section of our website.

Our impact

Over the past few years, we’ve also started to estimate our impacts, converting them into monetary terms using our proprietary methodology – Total Impact Measurement and Management (TIMM). It’s helped us measure the relative scale of our economic, tax, social and environmental contributions – both positive and negative, and better understand and manage the trade-offs. You can read more in the Total impact section of our website.

Creating value for our stakeholders

Our business creates value for many different stakeholders, in different ways. We provide our clients with professional skills and services that help them achieve their goals. Our audit practice has an additional role in providing confidence to both shareholders of our clients and to our regulators in the quality of the corporate and financial information published by our clients. Of course, our people benefit from the jobs we provide and through the development opportunities we offer.

Beyond this narrow view of stakeholders, the Treasury receives taxes borne and collected by our business, and our suppliers are supported by the procurement of goods and services we require. Our communities benefit from the skills of our people, whom we encourage to volunteer as part of our engagement and leadership programmes.

At a more macro level, we make a significant contribution to the UK economy through the gross value added (GVA) from our operations, and from the spending in the economy by employees in our value chain.

Finally, our alumni provide talent for other businesses, and our thought capital and know-how make a contribution to business and society more generally.

On the other hand, our operations do have some negative impacts – on the environment - albeit small. Our programmes to reduce these are ongoing, and we have already made considerable progress, as described in the environmental section of this website, and in our sustainability scorecard. We remain committed to minimising the natural capital depletion arising from our operations, as quickly as practical.